Vantage FX

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountVantage FX, operating since 2009, is an STP broker that offers a wide range of financial services. On the broker’s official website, traders can trade currency pairs on the Forex market, as well as contracts for difference (CFDs) on US, Australian, and European stocks, as well as commodities and indices. Vantage FX is regulated by four authoritative bodies: the UK Financial Conduct Authority (FCA, license number 590299), the Australian Securities and Investments Commission (ASIC, license number 428901), the Vanuatu Financial Services Commission (VFSC, license number 700271) and the Cayman Islands Monetary Authority (CIMA, license number 1383491). Over the years, the company has won 11 prestigious awards in the field of financial services.

-

Account currency

AUD, USD, GBP, EUR, SGD, CAD

-

Minimum deposit

From $50

-

Leverage

Up to 1:20 (for equity CFDs), up to 1:500 (for currency pairs)

-

Spread

From 1.4 points (Standard STP), from 0.4 points (ECN)

-

Instruments

Currency pairs (44), CFDs on stocks (226), indices (16), commodities (19)

-

Margin call / Stop out

100/50%

Pros

- Variety of trading instruments: more than 250 currency pairs and CFDs.

- Licensed by four leading international regulators, confirming the reliability and level of trust in the broker.

- Availability of classic trading platforms and a mobile application developed by the broker, providing convenience and accessibility of trading.

- Providing free trading signals to all traders, regardless of their trading account type.

- Favorable conditions of the bonus policy and partnership program that make cooperation with the broker especially attractive.

Minuses

- Restrictions on clients from many countries who can only work with a branch with an offshore license, which may cause some concern among traders about regulatory protection.

- Insufficient educational materials: the company offers limited resources for beginners who want to learn how to trade Forex.

- The withdrawal process can be lengthy and requires compliance with special conditions, which can cause inconvenience among clients seeking quick and easy liquidity of their assets.

Customer geography

-

France 25.52%

France 25.52% -

Thailand 11.55%

Thailand 11.55% -

United Kingdom 11.17%

United Kingdom 11.17% -

Belgium 8.58%

Belgium 8.58% -

Switzerland 6.64%

Switzerland 6.64% -

Malaysia 6.19%

Malaysia 6.19% -

Germany 5.77%

Germany 5.77% -

Australia 5.5%

Australia 5.5% -

Italy 5.49%

Italy 5.49% -

Turkey 5.3%

Turkey 5.3% -

Others 41.29%

Others 41.29%

Expert evaluation

Vantage FX is a broker specializing in ECN trading, which gives traders direct access to the market and liquidity providers, thus reducing trading costs. Two types of ECN accounts are available for different levels of experience: standard and advanced for professionals with large investments.

The broker is especially suitable for active traders who prefer dynamic trading, including scalping and the use of automated trading systems. At the same time, there may not be enough options for passive investors. Vantage FX clients can choose between different commission models – spread-based or flat-rate, which makes it easy to customize the trading process according to their strategies.

The broker maintains high security standards by requiring verification for withdrawal transactions. This ensures the protection of clients’ financial transactions. The Vantage FX support team is responsive and ready to help with any questions, speeding up the resolution of problems that arise.

Analysis

Ribeit

Rebate from MOFT offers an effective way to reduce brokerage commissions. By registering on the Traders Union portal and opening an account through the Traders Union referral link, traders start receiving a spread rebate for every transaction on the Forex market, including both profitable and losing trades. This rebate is available to VantageFX broker clients who have joined through MOFT.

Try this opportunity – you will appreciate its advantages!

Trading condition

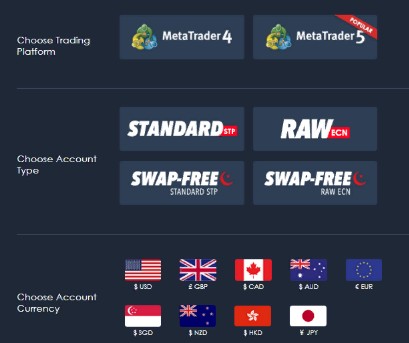

Vantage Markets offers its clients a wide range of trading instruments, including more than 200 products, including 44 currency pairs. The popular MetaTrader 4 and MetaTrader 5 platforms are available for market operations, as well as the company’s proprietary mobile application Vantage FX App, which is compatible with iOS and Android devices.

Clients are offered various account types, including a standard STP account and two ECN account variants, one of which is RAW ECN. The broker also offers margin trading with leverage ranging from 1:20 to 1:500 and supports swap-free trading for Muslim clients. A free demo account is available for novice traders, which can be used without time limits.

-

Trading platform

Vantage FX App, МТ4 (Desktop, Mobile, Web), МТ5 (Desktop, Mobile), WebTrader

-

Accounts

Demo, Standard STP, Pro ECN, RAW ECN

-

Account currency

AUD, USD, GBP, EUR, SGD, CAD

-

Deposit/withdrawal

Bank transfer, Visa and Mastercard, payment systems Neteller, Skrill, FasaPay, Thailand Instant Bank, PayPal

-

Minimum deposit

From $50. USD

-

Leverage

Up to 1:20 (for equity CFDs), up to 1:500 (for currency pairs)

-

PAMM accounts

no

-

Minimum order

0,01

-

Spread

From 1.4 points (Standard STP), from 0.4 points (ECN)

-

Instruments

Currency pairs (44), CFDs on stocks (226), indices (16), commodities (19)

-

Margin call / Stop out

100/50%

-

Liquidity provider

15 major banks, including J.P. Morgan, Citibank, HSBC, Credit Suisse and others

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Execution

-

Trading features

Automated trading is available

-

Contests and bonuses

Bonus on deposit 50%, discount on commissions up to 8 USD per lot for active traders

Commissions

Analysts of the International Organization of Forex Traders (IOFT) conduct a thorough analysis of trading conditions of various brokers to assess the impact of commissions on trading performance. Their study of OctaFX trading conditions revealed that the broker charges trading commissions in the form of spread on all types of accounts, which is a standard practice in the market.

OctaFX does not deduct commission from clients for deposit and withdrawal of funds, which is a significant advantage for traders. However, it should be noted that individual payment systems may apply their own transaction fees, which clients are advised to find out in advance from their financial institutions or electronic payment systems.

For users of the MetaTrader 5 (MT5) platform, OctaFX offers swap-free accounts, which can be particularly attractive for traders using long-term trading strategies. Also, traders using MetaTrader 4 (MT4) can choose to open an Islamic account, which is exempt from swaps and other types of Sharia-compliant fees.

These conditions underline OctaFX’s transparency and flexibility in providing services to its clients, allowing traders to optimize their trading strategies and minimize costs associated with commissions.

Broker Overview

Vantage FX gives traders the freedom to choose their strategies, including scalping, intraday, medium and long-term operations. The broker supports the use of trading advisors and does not limit automated trading. Orders are executed using the Market Execution method, providing clients with fast and accurate order execution.

Vantage FX, thanks to ECN technology, provides direct access to liquidity providers, reducing trading costs by minimizing spreads. The broker offers a wide range of trading instruments, including currency pairs, CFDs on stocks, indices and commodities. Access to MyFxBook, ZuluTrade and DupliTrade trade copying platforms also expands opportunities for investors.

Trading is performed through the popular MetaTrader 4 and MetaTrader 5 terminals, as well as through Vantage FX App, a proprietary mobile application available on Android and iOS. This platform supports one-click trading.

Additional Vantage FX amenities:

- MetaTrader Extensions: Access to various tools such as Alarm Manager, Correlation Matrix and Market Manager improves traders’ analytical capabilities.

- VPS Servers: Ensure stability of automated strategies even if the local terminal is turned off.

- Forex Sentiment Indicators: Clearly show the ratio of open buys and sells, helping you make informed decisions.

- Pro Trader Tools: Professional analytical services are available for deposits from 1000 USD.

Types of trading accounts:

- Standard STP: Minimum deposit 50 USD, commission in the form of spread starts from 1.4 pips.

- RAW ECN: Minimum deposit 50 USD, fixed commission 3 USD per lot.

- Pro ECN: Requires a minimum deposit of 10,000 USD with a commission of 2 USD per lot. Includes access to Pro Trader Tools.

Vantage FX bonuses:

- First deposit bonus: 50% of the amount up to 20 000 USD.

- Commission Bonus: Refund up to 8 USD per lot for active traders depositing from 10 000 USD.

Withdrawals:

- Processing to Visa/Mastercard cards takes 3-5 days.

- Bank transfers are executed on the day of application submission during business hours.

Support service:

- 24 hours a day on weekdays via online chat, email and phone.

This extensive offering makes Vantage FX an attractive choice for a variety of traders looking for reliability and flexibility in trading the global financial markets.

Advantages

- Wide range of instruments: more than 250 trading instruments allow traders to diversify their portfolio.

- Protection against negative balance: the broker provides additional security guarantees, preventing the possibility of the balance falling below zero.

- Proprietary mobile platform: the Vantage FX mobile app is designed for the convenience of traders on the go, supported by iOS and Android devices.

- Low commissions: one of the key advantages that makes trading more profitable.

- Analytical tools: having a variety of tools to analyze the market helps traders make informed decisions.

- Automated trading: support for trading robots and algorithms that simplify the trading process.

- No restrictions on trading strategies: traders can apply any strategy without restrictions, making the platform ideal for all types of traders.

Vantage FX Personal Cabinet Overview

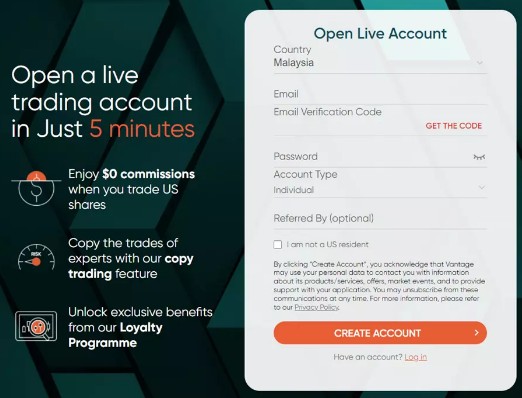

To get started with Vantage FX broker, the first step is to register on the platform. Here is a quick guide on how to register:

- Getting Started: Click on the “Live Account” button at the top of the home page.

- Filling in the registration form: You will be asked to fill in the following fields:

- First name

- Surname

- Country of residence

- Phone number

- Account type (Individual, Company)

- Specifying additional information: The broker will request information about date of birth, type and number of the document that will be used for verification.

- Place of residence: Enter your actual address, region, city and zip code.

- Financial Information: Fill in employment, monthly income, savings and investments, and source of income.

Setting up and using a personal account:

- Trading account setup: Select your trading terminal, account type and base currency.

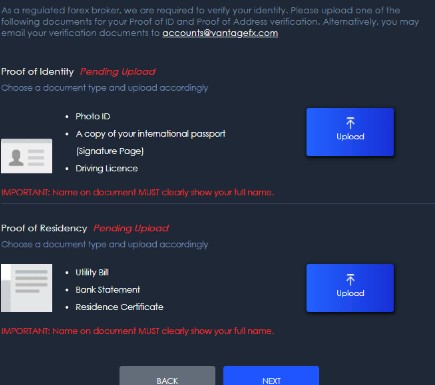

- Account Verification: Upload documents to verify your identity and address.

- Use of trading tools: Pro Trader Tools, trading signals and training videos become available after deposit of 1000 USD or more.

This registration process not only provides access to a multitude of trading tools and features, but also maintains high standards of security and transparency of transactions on the Vantage FX platform.

Answers to questions

-

What types of trading accounts are available with Vantage FX

-

What documents are required for account verification

-

Can I trade on Vantage FX from a mobile device

-

What safeguards does Vantage FX employ to ensure the security of client funds

-

What fees and commissions does Vantage FX charge

-

Does Vantage FX offer trade copying services

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ