InstaForex

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountInstaForex, actively operating on international financial markets since 2007, has more than 7 million traders from over 140 countries. The broker offers a wide range of trading instruments, including cryptocurrencies and synthetic indices, totaling more than 2500 items. The company is constantly working to improve its services, offering the latest technological solutions and analytical tools to maintain and develop its competitive advantages.

Structure and licensing

InstaForex consists of several companies registered and licensed in different jurisdictions:

- Instant Trading Ltd. – licensed by BVI FSC (British Virgin Islands, SIBA/L/14/1082).

- Instant Trading EU Ltd. – licensed by CySEC (Cyprus, 266/15).

In addition, the broker is registered with such regulators as BaFin (Germany), AFM (Netherlands), MFSA (Malta), as well as with regulators in Greece, UK and Czech Republic, which emphasizes its commitment to high standards of regulation and transparency.

InstaForex continues to be one of the key players in the global forex broker arena, offering its clients access to an extensive portfolio of trading opportunities and reliable regulation, making it an attractive choice for both novice and experienced investors.

-

Account currency

FSC - USD, EUR, RUB. CySEC - EUR, USD, PLN, CZK, GBP (GBP - only for MT5 accounts).

-

Minimum deposit

FSC - 1 USD for all accounts. CySEC - 200//1000/2000/10000/50000 EUR depending on the account type

-

Leverage

FSC - up to 1:1000. CySEC: for retail traders - up to 1:30, for professional traders - up to 1:500.

-

Spread

FSC - from 0-0.3 pips depending on the type of account. CySEC - from 0 pips depending on the type of asset.

-

Instruments

FSC - currency pairs, stocks, indices, metals, oil and gas, commodity futures, cryptocurrencies, instaFutures. CySEC - currency pairs, commodities, equities, indices, cryptocurrencies, synthetic stocks and ETFs, stocks at the time of IPO.

-

Margin call / Stop out

FSA — 30%/10%. CySEC — 100%/50%

Pros

- Diversity of trading instruments: InstaForex stands out in the market with more than 2,500 trading instruments, including unique assets such as InstaFutures and synthetic securities. This diversity provides traders with more opportunities for investment and speculation.

- Passive Investment Products: The Company offers various passive investment options, including PAMM accounts and a trade copying service. These tools are ideal for investors who prefer to minimize their involvement in the trading process.

- Innovative technological solutions: InstaForex constantly introduces advanced technologies, such as InstaSpot for P2P spot trading, OYS-accounts, and Basket of Shares, which strengthens its position in the market as an innovative broker.

- European regulation and protection of funds: Due to regulation in Europe and availability of IFC compensation fund, InstaForex clients are protected with guaranteed reimbursement up to 20 thousand euros, which increases confidence and safety of investments.

- Favorable trading conditions: With a minimum deposit of 1 USD and leverage up to 1:1000, InstaForex offers some of the most attractive conditions for FSC-regulated traders, making it affordable and appealing to a wide range of traders.

Minuses

- Tough conditions for European traders: Regulatory requirements in Europe introduce restrictions for retail traders, which may reduce the attractiveness of InstaForex for this audience. Stringent conditions include leverage restrictions and strict reporting rules, which may affect the flexibility of trading strategies.

- Delays in copying trades: In InstaForex social trading service there is a time lag between execution of the trader's original trade and its copying to the investor's account, which can be up to 15 seconds. This can lead to loss of potential profit, especially in conditions of high market volatility, where every second counts.

Customer geography

-

Russia 45.93%

Russia 45.93% -

Belarus 15.27%

Belarus 15.27% -

Ukraine 5.41%

Ukraine 5.41% -

Kazakhstan 2.54%

Kazakhstan 2.54% -

Bangladesh 1.78%

Bangladesh 1.78% -

Mozambique 1.77%

Mozambique 1.77% -

Slovakia 1.76%

Slovakia 1.76% -

Lebanon 1.09%

Lebanon 1.09% -

Ireland 0.89%

Ireland 0.89% -

Germany 0.43%

Germany 0.43% -

Others 7.14%

Others 7.14%

Expert evaluation

InstaForex, operating on the market since 2007, has established itself as a broker with a stable reputation. The company offers a wide range of trading conditions adapted both for beginners and experienced traders. The advantages include the possibility to trade with the minimum order volume of 0.01 lot and access to more than 2500 Forex instruments.

Based on the analysis of an extensive number of client reviews, it can be noted that InstaForex has a high degree of client trust. The majority of reviews confirm the efficiency of the support service, which promptly responds to users’ requests and helps to solve both technical and financial issues.

The official website of InstaForex is characterized by convenient navigation, which allows users to easily find information about various aspects of trading. The company focuses on creating favorable conditions for all categories of traders, supporting their activity at every stage of work.

In general, InstaForex continues to maintain a high level of service, emphasizing on constant improvement of the trading experience of its clients.

Analysis

Ribeit

InstaForex offers one of the most attractive rebate programs on the Forex market, allowing traders to earn extra money on every trade regardless of its outcome. Let’s take a look at how it works and how you can increase your trading income using this service.

How InstaForex rebate program works

- Trading account registration: To participate in the program you should open a real trading account with InstaForex or register an existing one. You can do it directly on the company’s website.

- Automatic registration in InstaRebate: After opening an account, your account is automatically included in the InstaRebate system.

- Trading in the usual mode: You continue trading as usual. The key point is that you receive a fixed payout of $15 for each closed market lot.

Examples of InstaForex rebates

Example 1: Suppose you opened and closed a EUR/USD trade of 1 standard lot. Regardless of whether the trade made a profit or a loss, you will receive $15 cashback.

Example 2: If your total trading volume for the month was 22.4 standard lots, your rebate reward for this period will be $336.

Benefits of the Rebate Program

- Additional income: The Rebate Program provides a stable source of additional income in addition to traditional trading profits.

- Ease of participation: No additional actions are required to participate in the program. All you need to do is trade as normal.

- Support service support: In case of any questions or problems, InstaForex support team is always ready to provide the necessary assistance.

How to get started

To start receiving rebates, simply open an account with InstaForex, register in the InstaRebate program and start trading. Your rebates will be automatically credited for each closed lot, increasing your total income from Forex trading.

Trading conditions

Trading conditions and opportunities for traders can vary significantly depending on which regulator the broker operates under:

FSC (Financial Services Commission)

Under FSC regulation, traders face more flexible conditions. The minimum deposit is only 1 USD, which allows traders with any capital to start trading. Leverage up to 1:1000 is also available, which opens wide opportunities for capital management in various markets. The broker offers PAMM accounts and social trading opportunities, which allows investors to capitalize on the success of experienced traders.

It is important to note that the broker uses reduced lot sizes – 10,000 basic units instead of the standard 100,000, which makes the cost per pip more affordable and manageable for traders.

CySEC (Cyprus Securities and Exchange Commission)

Under CySEC regulation the conditions are stricter due to European regulations. The minimum deposit starts from 200 USD, and the maximum leverage for traders without professional status is limited to 1:30. Instead of PAMM accounts and social trading, CySEC-regulated brokers can offer managed stock portfolios and investments in synthetic stocks/ETFs.

General conditions

Regardless of the regulator, the spread level can start from 0 pips, which depends on the selected account type and the traded asset. This gives traders the opportunity to choose the terms that best suit their trading strategy and financial goals.

Thus, the choice of broker regulator affects the trading environment and can significantly impact your trading experience and strategy.

-

Trading platform

MT4, MT5, mobile trading, multi-terminal, WebTrader (InstaForex development)

-

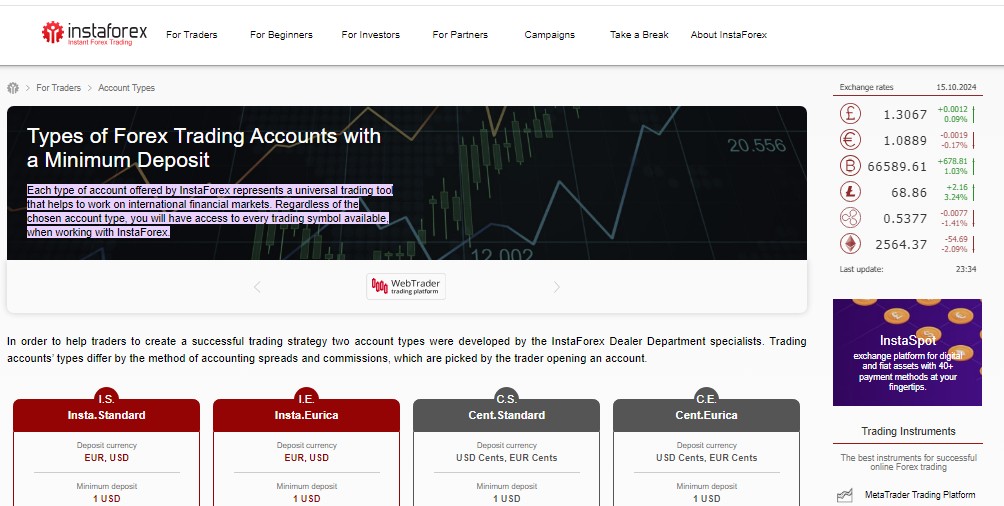

Accounts

FSC — Demo, Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica. CySEC — ECN, ECN Pro, ECN VIP for MT4 and MT5.

-

Account currency

FSC - USD, EUR, RUB. CySEC - EUR, USD, PLN, CZK, GBP (GBP - only for MT5 accounts).

-

Deposit/withdrawal

FSC - cash, bank card, cryptocurrencies (BTC, LTC, ETH, USDT), PayCo, Webmoney. CySEC - Visa/Mastercard, Bank Transfer, Skrill, Neteller, Rapid, iDeal, Przelewy24 and BLIK, GiroPay, Payoma.

-

Minimum deposit

FSC - 1 USD for all accounts. CySEC - 200//1000/2000/10000/50000 EUR depending on the account type

-

Leverage

FSC - up to 1:1000. CySEC: for retail traders - up to 1:30, for professional traders - up to 1:500.

-

PAMM accounts

yes

-

Minimum order

From 0.01 lot

-

Spread

FSC - from 0-0.3 pips depending on the type of account. CySEC - from 0 pips depending on the type of asset.

-

Instruments

FSC - currency pairs, stocks, indices, metals, oil and gas, commodity futures, cryptocurrencies, instaFutures. CySEC - currency pairs, commodities, equities, indices, cryptocurrencies, synthetic stocks and ETFs, stocks at the time of IPO.

-

Margin call / Stop out

FSA — 30%/10%. CySEC — 100%/50%

-

Liquidity provider

Barclays, Citibank, HSBC, J.P.Morgan, Morgan Stanley, UBS, Nomura

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Instant Execution, Market Execution

-

Trading features

Opportunity to open segregated and Islamic (swap-free) accounts, hedging of currency risks, cryptocurrency trading

-

Contests and bonuses

There is a broker under FSC regulation

Commissions

Our analysts have made a detailed study of InstaForex trading conditions, especially focusing on the aspects of explicit and hidden commissions. All information about commissions is available on the broker’s official website, which ensures transparency and allows traders to fully plan their expenses.

Fees for account replenishment

One of the advantages of InstaForex is that there is no commission for replenishment of trading accounts via popular payment systems. However, it should be taken into account that the commission may be charged by the bank or payment system through which the transaction is made. To clarify the size of these commissions, traders are recommended to refer to the official sources of the relevant financial institutions.

Fee structure depending on the type of account

InstaForex offers a flexible commission system, which depends on the chosen account type, trading platform, asset type and deposit amount. For example:

- Standard (FSC) accounts: There is no commission, which makes them an attractive option for traders who prefer standard trading conditions.

- Eurica accounts (FSC): Here the commission varies from 0.03% to 0.07%, depending on the volume of trades and selected assets.

- ECN accounts (CySEC): For these accounts the commission rate is individual and depends on the specifics of the traded asset.

Choosing a suitable trading account with InstaForex should take into account both the type of preferred trading operations and potential commissions. Due to the variety of offered conditions, traders can optimize their trading strategies, reducing the necessary costs as much as possible. This makes InstaForex an attractive choice for a wide range of traders seeking efficient and cost-effective trading.

Broker Overview

InstaForex, one of the leading brokers on the Forex market, offers its clients a wide range of financial instruments beyond traditional currency pairs. The range includes precious metals, cryptocurrencies and stock market assets, which makes the company attractive for a wide range of investors. InstaForex is known for its high level of service and close cooperation with leading software developers such as Reuters, eSignal and MetaQuotes Software, thanks to which the company was one of the first to offer cryptocurrency trading.

InstaForex key metrics

- Client base: Over 7 million traders worldwide.

- Investments in PAMM accounts: Over 10 million US dollars.

- Global presence: More than 250 representative offices of international level.

- Market experience: More than 16 years of successful work.

InstaForex is the optimal choice for both active and passive investors, offering different types of accounts to meet the needs of a diverse clientele:

- Cent.Standard and Cent.Eurica: Ideal for beginners with minimum trades from 0.10 lot.

- Insta.Standard and Insta.Eurica: Focused on professionals, offering unlimited trading.

- ECN accounts (CySEC): Including ECN MT4 and MT5, offering floating spreads and access to a wide range of assets.

Innovative services and technologies

InstaForex not only supports traditional trading platforms such as MetaTrader 4 and MetaTrader 5, but also offers a number of its own developments:

- InstaSpot: P2P trading, providing direct transactions between participants.

- Economic and trading calendars: Important tools for planning trading operations.

- Forex Charts and Pattern Graphix: Indispensable tools for real-time market analysis.

- Superior Forex Desk: A plug-in for MetaTrader 4 that simplifies order management.

Bonus programs

InstaForex also offers profitable bonus programs for traders working under FSC regulation, including 100% bonus for the first deposit and other attractive offers that enhance the investment potential of clients.

InstaForex continues to demonstrate its commitment to innovation and high quality service, making it one of the most preferred brokers in the global Forex market.

Advantages

- Diversity of investment products: InstaForex offers a wide range of investment solutions. PAMM-accounts and social trading opportunities are available for clients under FSC regulation, allowing them to earn on the experience of successful traders. Under CySEC regulation, the broker provides opportunities for investing in equity baskets and managed diversified portfolios.

- Direct P2P trading: InstaForex facilitates direct trading between participants without intermediaries, which allows making transactions on mutually beneficial conditions with fixed rates.

- Trading synthetic assets without swaps: For clients regulated by CySEC, the broker offers a unique opportunity to trade synthetic stock assets without any swap costs, thus reducing overnight commissions.

- Extensive catalog of trading assets: InstaForex offers access to more than 2500 trading assets, including a variety of ETFs and cryptocurrencies, which makes the platform attractive for a wide range of traders.

InstaForex account overview

How to start Forex trading through InstaForex broker

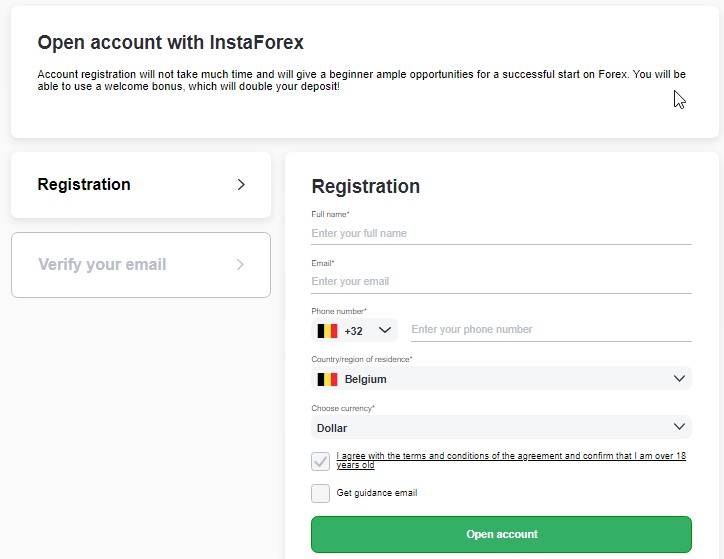

Step 1: Account registration

To start working with InstaForex, go to the broker’s official website and click the “Open an account” button on the main page. This will redirect you to the registration form.

Step 2: Complete the registration

Fill in the required fields of the registration form, including your name, phone number and e-mail address. You will be sent a confirmation code to the specified contact (phone or email), which you will need to enter to complete the registration process. After that, be sure to go through the verification process before you start trading.

Functionality of the personal cabinet

The following functions are available in your personal cabinet on InstaForex website:

- Depositing and withdrawing funds: Direct access to financial transactions, allowing you to manage your funds efficiently.

- Manage your trading account information: Overview of all key data of your account, including current balance, open positions and more.

Additional features

- Trading Statistics: Integration with ForexCopy social trading platform and access to PAMM accounts analytics.

- Verification: An important step to confirm your identity and the safety of your funds.

- News and promotions: Constant updates on company news and current promotions.

- Customer support: Prompt assistance in solving any questions or problems.

InstaForex provides a wide range of tools and resources for comfortable and efficient Forex trading, making the platform convenient for both beginners and experienced traders.

Answers to questions

-

How to register with InstaForex broker

-

What types of accounts does InstaForex offer

-

What deposit methods are available in InstaForex

-

Does InstaForex charge commission for deposit and withdrawal of funds

-

What instruments are available for trading in InstaForex

-

Does InstaForex have a license to operate?

-

How to contact InstaForex support service

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ