FxGlory

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountFXGlory, a brokerage company, was founded in 2011 in the United Arab Emirates. Having started its operations in the Asian financial market, a year later the company expanded its presence to include European markets as well. The company is registered in St. Lucia (registration number 2023-00207) and has representative offices in the UK, Switzerland and Cyprus.

FXGlory specializes in providing traditional forex services, covering all key aspects of the forex market. The main focus is on active trading, and the company also offers binary options trading opportunities.

However, it is worth noting that FXGlory is not licensed by any known regulatory bodies. This point is important to consider when deciding to start cooperation with the broker, as it may affect the level of trust and investment protection.

-

Account currency

USD

-

Minimum deposit

From US$1

-

Leverage

1:3000

-

Spread

From 2.0 points (from 0.1-0.7 points for VIP, CIP accounts)

-

Instruments

Currencies, metals, oil

-

Margin call / Stop out

20%/10% — 60%/30%

Pros

- Minimum Deposit: One of the significant advantages of FxGlory is the possibility to start trading with just 1 US dollar. This makes the broker accessible for beginners and those who want to test strategies with minimal risks.

- Flexibility in the choice of trading strategies: FxGlory does not impose restrictions on the use of trading strategies. The broker supports scalping, hedging and algorithmic trading, which gives traders the freedom to choose their trading approach and develop their own methods.

Minuses

- Order Processing Model: FxGlory uses the STP model (Straight Through Processing), which means that orders are placed only with liquidity providers, without access to the ECN system (Electronic Communication Network). This can limit traders in terms of market depth and getting the best prices.

- High spreads: A standard FxGlory account is characterized by spreads from 2 pips, which is higher than many competitors. This is a consequence of the STP model and can increase trading costs.

- Commission policy: The Company has a complex policy regarding commissions and minimum withdrawal amounts, which can cause difficulties in planning financial transactions. Commissions may vary depending on the payment system selected and the amount of the transaction.

- Language limitations: The FxGlory website is only available in English, which can be a barrier for non-English speaking traders.

- No cent accounts: The broker does not offer cent accounts, which may be convenient for beginners or traders wishing to test strategies with minimal risks.

- Lack of regulation: FxGlory is not regulated by any reputable financial regulator, which may increase risks for clients in terms of protecting their investments.

- Support delays: Traders have noted delays in responses from the support team, which can cause inconvenience when dealing with urgent issues.

Customer geography

-

United States 94.8%

United States 94.8% -

Canada 7.5%

Canada 7.5% -

Mexico 3.9%

Mexico 3.9% -

Poland 3.6%

Poland 3.6% -

South Africa 3.6%

South Africa 3.6% -

United Kingdom 3.4%

United Kingdom 3.4% -

Japan 3.2%

Japan 3.2% -

Malaysia 3.1%

Malaysia 3.1% -

Indonesia 3.1%

Indonesia 3.1% -

Others 3.8%

Others 3.8%

Expert evaluation

For a trader from Europe, FXGlory represents a decent choice among classic brokers, especially for intraday trading. However, for CIS traders, brokers with Russian-speaking support and a more flexible trading system may be more preferable. I should note that FXGlory’s STP model of order processing results in less competitive spreads, as it is limited to fixed liquidity providers and does not include the free pricing typical of ECN systems. It is also worth being careful about withdrawal policies and the lack of a regulatory license, which can add risks in case of disputes.

The FXGlory website is informative and user-friendly, with a full description of trading conditions and investment products. The company fulfills its obligations under the partnership agreement and payment of rebate, thanks to which it occupies a place in the MOFT rating of Forex brokers.

Analysis

Ribeit

Despite FXGlory’s high spreads, traders have the opportunity to reduce their trading costs thanks to a partial spread compensation system through MOFT’s rebate service. Here’s how it works:

- MOFT Registration : Register for free on the official MOFT website.

- Account opening: Open a trading account with FXGlory broker using MOFT affiliate link.

- Trading and Ribeit Crediting: You start trading and the Ribeit is credited to your balance in MOFT myAlpari after each trade, regardless of their performance.

Compensation depends on the volume of trading:

- FXGlory’s rebate for MOFTs ranges from 1 to 1.9 pips per lot, depending on your trading volume.

- For CFDs on some metals, there is a fixed payout amount, details of which are available on the MOFT website or from the support team.

- You, as a trader, receive 80% of the rebate amount paid by MOFT from FXGlory.

Example of rebate calculation: Suppose you trade EUR/USD, opening 1 lot every day. The pip cost for 1 lot is 10 USD, the spread is 2 pips. The daily cost of the spread will be 20 dollars. If MOFT receives 1 pip per lot from FXGlory, that’s $10, of which you will be paid 80%, which is an $8 return for each lot traded.

This system gives you the opportunity to significantly reduce your trading costs, making every trade more profitable. Try it and see the benefits!

Trading conditions

FXGlory’s trading conditions are characterized by a certain strictness, especially with regard to the entry threshold for professional traders. It is important to note the following aspects:

- Minimum Deposit: Although FXGlory offers the opportunity to start trading with a minimum deposit of $1 USD, such conditions are only available on one basic account, which has its own limitations. This account may not be suitable for all categories of traders, especially those looking for advanced trading opportunities.

- Average Entry Threshold: For most of the other accounts offered by FXGlory, the initial deposit starts at $1,000. This can be a significant amount for beginners or traders who are not ready for a large investment at the beginning of their trading career.

These conditions make FXGlory more suitable for experienced traders willing to invest larger sums in their trading activities, while novice traders may need to consider other options with lower initial capital requirements.

-

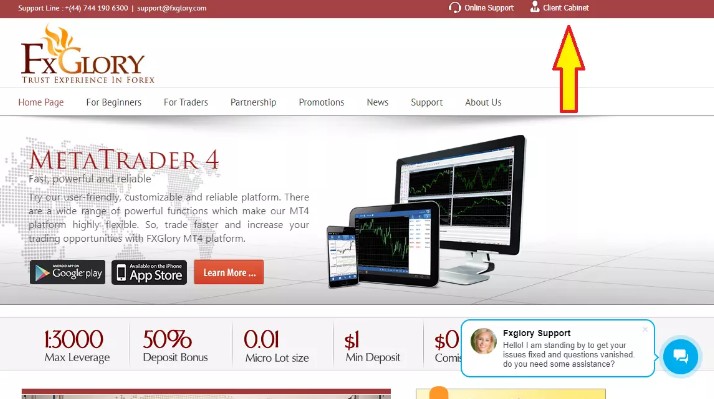

Trading platform

MT4 (browser and desktop versions)

-

Accounts

Standard, Premium, VIP

-

Account currency

USD

-

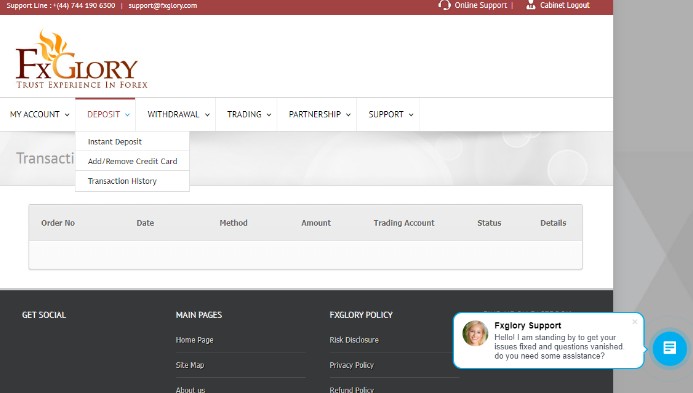

Deposit/withdrawal

SticPay, American Express, Perfect Money, cryptocurrencies, WebMoney, EPay, Wire Transfer, Neteller, Skrill, PayPal, Visa, Mastercard

-

Minimum deposit

From US$1

-

Leverage

1:3000

-

PAMM accounts

no

-

Minimum order

0.01

-

Spread

From 2.0 points (from 0.1-0.7 points for VIP, CIP accounts)

-

Instruments

Currencies, metals, oil

-

Margin call / Stop out

20%/10% — 60%/30%

-

Liquidity provider

no data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Instant Execution, Market Execution

-

Trading features

There is a VPS-server for VIP accounts

-

Contests and bonuses

yes

Commissions

MOFT analysts conducted a detailed analysis of trading conditions offered by FXGlory broker, paying special attention to the commission structure. Here are the main conclusions of the analysis:

- Transparency: FXGlory’s trading conditions are rated as transparent. The broker clearly indicates all applicable commissions, which allows traders to plan their costs in advance.

- Level of Commissions: Despite the transparency, the overall level of commissions at FXGlory is considered to be quite high. This can significantly increase trading costs, especially when trading actively.

- Hidden fees : There are no hidden fees, which is a positive aspect. Traders can be sure that all trading costs will be known in advance without unforeseen fees.

- Spreads and withdrawal fees : The broker applies spreads and also charges withdrawal fees. These commissions should be taken into account when organizing the withdrawal process.

- Swaps: Commissions for carrying a position to the next day (swaps) are also present. These fees can affect the cost of holding open positions overnight, which is important for long-term trading strategies.

Thus, despite the transparency and lack of hidden commissions, the overall level of trading costs at FXGlory can be significant. Traders are advised to carefully evaluate these terms and conditions in the context of their trading strategies and financial capabilities.

Broker Overview

FXGlory has confidently occupied its niche among companies providing classic professional trading services since its establishment in 2011 in the United Arab Emirates. The broker’s commitment to technological advances is evident in its order processing and distribution system, which in the future will allow traders to directly access the ECN market. This will potentially reduce order execution times, provide traders with more in-depth market data and reduce spreads by increasing market liquidity.

FXGlory Key Features:

- Minimum deposit: as low as $1, making it accessible to a variety of traders.

- Leverage: offers up to 1:3000.

- No turnover fee: encourages trading by reducing transaction costs.

- Deposit Bonus: generous 50% bonus on every deposit made.

Trading model and account types: FXGlory uses the STP (direct order processing) model, which connects traders directly to liquidity providers. This model supports high volume trading without the fear of slippage due to lack of liquidity and does not charge a lot fee, which can be especially beneficial for active traders.

FXGlory trading conditions are focused on attracting professional traders with significant capital, but there is also one type of account for beginners with a minimum deposit of 1 dollar and leverage of 1:3000. However, to reduce risks, the broker has set the upper threshold of the total volume of open trades at 1 lot.

Types of Accounts:

- Standard: for beginners with a minimum deposit of 1 dollar and a maximum position volume of 1 lot.

- Premium: for professional traders with a minimum deposit of 1000 dollars. The maximum volume of transactions is 10 lots.

- VIP: for trading large volumes of positions. Minimum deposit – 5000 dollars, maximum position volume – up to 1000 lots.

- CIP: for institutional investors, minimum deposit – from 50 thousand dollars. Maximum position volume – 5 lots.

Trading platform and bonuses: Traders can familiarize themselves with the trading environment through a demo account or start trading immediately using MT4, available in a simplified browser-based version. Bonuses include a 50% credit on deposits and a fixed rebate on spreads, providing additional incentives to trade.

Withdrawals and Support: FXGlory prides itself on its efficient withdrawal process and supports multiple payment methods including SticPay, cryptocurrencies and more traditional options such as bank transfers and credit cards. The support team is available 24/5 through multiple channels to help with any questions or concerns.

In general, FXGlory positions itself as a broker suitable for both beginners and experienced traders, offering a variety of account types, competitive trading conditions and a reliable support system.

Advantages

- Risk minimization: The broker's trading conditions are designed to limit potential risks. This reduces the likelihood of losing trades caused by traders' emotional decisions.

- Demo account for training: The broker provides a training account (Standard), which allows traders to test and refine their trading strategies in conditions as close as possible to real market conditions.

- Trading flexibility: There are no restrictions on the use of trading advisors, position locking and scalping. This gives traders the freedom to choose trading strategies and techniques, tailoring the trading approach to their needs and preferences.

FXGlory personal account overview

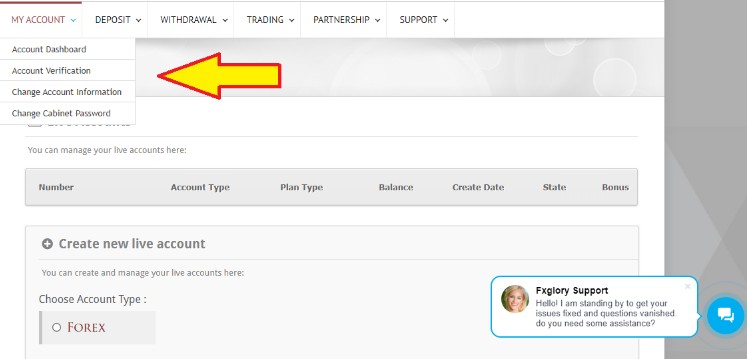

Your first step to trading with FXGlory broker starts with the account registration process. Here’s how you can do it:

- Go to the main page of the website and click on “Open a demo account”. You can also open a live account directly from the home page or via the “For Traders” menu.

- On the page that opens, download the MT4 trading platform and follow the suggested instructions. Note that opening a demo account does not provide access to myAlpari.

- To register and get access to myAlpari, click on the corresponding button at the top of the main page.

- Go through the authorization procedure by filling in the form offered by the broker and confirm your registration using the link that will be sent to your e-mail. After confirmation of registration, you will receive another e-mail with your login and password.

The following options will be available to you in your FXGlory Personal Cabinet:

- Management of open accounts;

- Tracking financial transactions (withdrawals, deposits, charges);

- Additional features in myAlpari include:

- A section for correcting personal data after verification;

- Statistics of income from attracted referrals;

- Support service for communication with the broker.

Answers to questions

-

What is the minimum deposit required to trade with FXGlory

-

What types of trading accounts does FXGlory offer

-

What deposit methods are available at FXGlory

-

Does FXGlory provide bonuses or promotions

-

Can I trade cryptocurrencies on FXGlory

-

How are my funds and personal information safeguarded

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ