Deriv

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountDeriv, formerly known as Binary.com until 2020, is part of the Regent Markets Group, a financial group founded in 1999. The broker operates on the STP model (MT5 terminals) and offers its own platform for options trading – Deriv Trader. Currently, Deriv services are used by traders from 190 countries.

The company provides free access to its products due to multi-regulation. Deriv’s activity is controlled by the Financial Commissions of Malta (MFSA), Labuan (Labuan FSA), Vanuatu (VFSC) and British Virgin Islands (BVI FSC). Deriv’s main specialization is trading leveraged forex and CFD instruments, as well as option contracts with multiples.

Deriv continues to develop and improve its trading platforms, offering clients reliable and efficient tools for successful trading on financial markets.

-

Account currency

USD, EUR, GBP, AUD

-

Minimum deposit

5-25$ depending on payment method

-

Leverage

Up to 1:30 (Forex), up to 1:150 (stock CFDs)

-

Spread

From 0.4 pips (on EURUSD)

-

Instruments

MT5: Forex, CFDs on stocks, stock and synthetic indices, cryptocurrencies, commodities, ETFsDeriv Trader: Multipliers options on various asset classes

-

Margin call / Stop out

100% / 50%

Pros

- Membership in The Financial Commission: Protects investments up to 20,000 euros, which guarantees additional security for traders.

- No trading commissions: A wide range of derivatives with floating and fixed spreads allows traders to choose the most favorable trading conditions.

- Affordability: The minimum bet for options trading is only $5, making trading accessible to a wide range of traders.

- Low initial deposit: Deposits can be made from 5 units of the base currency of the account (EUR, USD, GBP, AUD), which allows you to start trading with minimal investment.

- Adapted trading platforms: Deriv offers platforms adapted to specific markets, which ensures convenient and efficient trading.

- Segregated accounts: Clients' funds are kept in segregated accounts with major banks to ensure their safety and security.

- Two-Factor Authentication: Account protection with two-factor authentication adds an extra layer of security for traders.

Minuses

- Lack of MetaTrader 4 platform: The broker does not offer the popular and more understandable MetaTrader 4 platform for beginners, which may make it difficult for some traders to start trading.

- Unavailability of PAMM and MAM accounts: Deriv does not provide investment opportunities in PAMM or MAM trust management accounts, which limits passive investment options for clients.

- Lack of educational content: There are few educational materials on the company's website, which can complicate the process of learning and mastering trading strategies for novice traders.

Customer geography

-

South Africa 18.4%

South Africa 18.4% -

Nigeria 11.5%

Nigeria 11.5% -

Argentina 5.6%

Argentina 5.6% -

Libyan Arab Jamahiriya 5.65%

Libyan Arab Jamahiriya 5.65% -

Kazakhstan 5.29%

Kazakhstan 5.29% -

Bahrain 2.4%

Bahrain 2.4% -

India 1.1%

India 1.1% -

Peru 0.6%

Peru 0.6% -

United Arab Emirates 0.5%

United Arab Emirates 0.5% -

Others 31.5%

Others 31.5%

Expert evaluation

Deriv is a company with many years of experience in financial markets. Over the years of intermediary activity in the Forex, CFD and options markets, it has developed a unique model of brokerage services based on fair pricing and high-quality customer support.

Regulation and client protection

Deriv is regulated in four jurisdictions, which ensures a variety of trading conditions and a wide range of available instruments. The broker complies with all regulations of financial supervisory authorities, including keeping clients’ funds in segregated accounts, negative balance protection and KYC (Know Your Customer) procedure. Verification of accounts takes 1 to 3 days, after which money sent from cards and electronic systems appears on the balance almost instantly.

Loyal requirements and withdrawal convenience

Requirements for the first deposit are quite loyal – only 5, 10 or 25 units of the account base currency depending on the chosen payment method. Withdrawal conditions are also client-oriented, allowing you to withdraw a minimum profit of 5 to 10 euros or US dollars.

Trading Platforms

One of the key advantages of Deriv is the provision of the MT5 platform in different versions – web, desktop and mobile. This provides convenient access to trading at any time and from any device.

Deriv strives to make trading accessible and convenient for its clients by offering reliable and efficient tools for successful work on financial markets.

Analysis

Development dynamics

History and rebranding

Deriv Limited is a state-of-the-art binary options platform built on the success of Binary.com. With over 20 years of history, Binary.com has earned recognition and respect among traders around the world. In 2020, for its 20th anniversary, the company rebranded and launched Deriv, symbolizing a new stage in its development. Deriv is headquartered in the Channel Islands, confirming its high standards of safety and regulation.

Structure and regulation

Deriv Group manages its operations through three subsidiaries, each of which is licensed to provide services in different jurisdictions. This allows the broker to offer its services on a global level, ensuring a high level of trust and regulatory compliance.

Technological innovations and improvements

Deriv not only continues the traditions of Binary.com, but also significantly develops them. The new platform offers users an improved interface, wider trading opportunities and modern tools for analysis. This makes the trading process even more convenient and efficient for both beginners and experienced traders.

International recognition and accessibility

One of the key aspects of Deriv’s success is its international accessibility. Deriv’s official website is available in several languages, including Russian, which makes the broker’s services accessible to a wide audience. This allows traders from different countries to receive quality services and support in their native language.

Ribeit

Traders can significantly reduce the size of commissions for transactions by using the MOFT rebate service. To do this, it is necessary to quickly register on the MOFT website, select a suitable broker from the list and open an account using the Association’s referral link. This method of opening an account allows you to receive a bonus in the form of a rebate, which is a return of the spread in full or in part.

MOFT returns funds for all trades made by a trader, whether profitable or unprofitable. Bonuses are credited to the client’s personal cabinet on the MOFT website and can be withdrawn at any time, as the Association does not set limits on the minimum withdrawal amount. Withdrawal of the rebate is carried out in convenient ways for traders.

Try MOFT rebate service and feel all the benefits today!

Trading conditions

The range of available assets for Deriv clients varies depending on the chosen trading platform. The classic MetaTrader 5 terminal offers about 150 CFDs. The Deriv Trader author’s platform provides an opportunity to trade option contracts with a multiplier.

The maximum leverage on the various assets in Deriv is:

- Forex: up to 1:30

- Cryptocurrencies: up to 1:2

- Synthetic indices and ETFs: up to 1:5

- Commodities (metals, oil): up to 1:10

- Stock indices: up to 1:20

- Stocks: up to 1:150

Deriv thus offers its clients a variety of trading opportunities tailored to different asset classes and leverage levels.

-

Trading platform

MetaTrader 5, Deriv Trader

-

Accounts

Demo, Deriv MT5, Deriv Trader

-

Account currency

USD, EUR, GBP, AUD

-

Deposit/withdrawal

Cards (VISA, VISA Electron, Maestro, MasterCard), Skrill, Neteller, Jeton, online banking systems EPS, GiroPay, Przelewy24, Rapid Transfer, iDEAL, DP2P (exchange of funds between broker's clients)

-

Minimum deposit

5-25$ depending on payment method

-

Leverage

Up to 1:30 (Forex), up to 1:150 (stock CFDs)

-

PAMM accounts

no

-

Minimum order

from 0.001 lots

-

Spread

From 0.4 pips (on EURUSD)

-

Instruments

MT5: Forex, CFDs on stocks, stock and synthetic indices, cryptocurrencies, commodities, ETFsDeriv Trader: Multipliers options on various asset classes

-

Margin call / Stop out

100%/50%

-

Liquidity provider

no data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Exchange Execution (CFD on shares), Market Execution

-

Trading features

Fixed spreads on synthetic indices, no trading commission on all asset classes

-

Contests and bonuses

no

Commissions

The accounts provided by Deriv are STP, which means there is no brokerage commission for trades. Traders only pay for the trading spread, which can vary depending on the market situation. The minimum Deriv spreads on EUR/USD are 0.4 pips and the target value is 0.6 pips. Spreads on synthetic indices are fixed.

The broker does not charge a fee for clients’ financial operations, such as deposit and withdrawal of funds. However, commissions may be charged, as payment systems carry out transfers according to their internal regulations.

If the account is inactive for 12 months, the broker charges a service fee of USD 25 or equivalent in another currency every 6 months.

The CFD specification on the company’s website shows the amounts of swaps – commissions for carrying short and long positions overnight.

Broker Overview

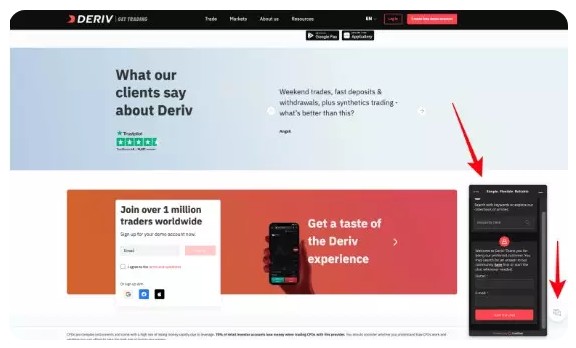

Deriv is a broker with more than 2.5 million clients, of which more than 1 million are actively trading on financial markets. Deriv’s network spans four companies with offices in 20 cities across Europe, Asia, Africa and Latin America. The total volume of contracts concluded with Deriv exceeds USD 15 trillion. The broker strives for honest and transparent relations with clients, does not charge hidden commissions and provides effective communication with users of its services.

Facts about Deriv:

- Founded more than 25 years ago.

- Rating on Trustpilot: 4.6 (based on over 43,000 reviews).

- MT5 trading: More than 475,000 Deriv customers trade on MT5.

- Available Assets: Over 150 CFDs.

- CFD trading commission: 0 EUR/USD.

Deriv trading opportunities

Deriv offers CFD and options trading. Trading of synthetic indices and cryptocurrencies is available 24/7, while other instruments are available 24/5. In EU countries, the broker offers two trading platforms: MT5 and Deriv Trader.

- MT5: Designed for leveraged trading of Forex and CFD assets.

- Deriv Trader: Allows you to trade Multipliers options. This type of trading ensures that a trader cannot lose more money than is involved in a trade, even when using leverage. If the position does not become unprofitable, the leverage-enhanced profit is paid out.

Deriv benefits and tools

- Multipliers: Allow you to reduce losses without limiting potential profits. Leverage increases buying power and the possible size of the loss.

- Online Margin Calculator: Helps you calculate the necessary funds to open and hold a position in MT5.

- Options Trading Robots: Off-the-shelf bots and a builder to create your own robot are available.

- Deriv Community: Clients can communicate, share experiences and trading strategies.

- Demo mode: Available on both MT5 and the proprietary Deriv platform.

- Online trading calculators: Help calculate margin requirements, pip sizes, swaps, stop loss and take profit levels.

Investment opportunities with Deriv

Deriv broker offers a variety of tools to automate the trading process, which allow traders to earn passive income on financial markets. Available investment solutions depend on the trading platform chosen by the client. Deriv also pays remuneration to partners who attract new active traders. It should be noted that trust management services based on MAM and PAMM models are not supported by the broker.

Deriv offers for passive earnings

After opening an account on Deriv platforms, clients can automate trading in the following ways:

- MetaTrader 5 (MT5):

- Copytrading: A type of social trading in which trades of signal providers are automatically copied to the accounts of subscribers (investors). It is the easiest way to trade Forex, suitable even for beginners without experience.

- Expert Advisors (EA): Tools for algorithmic trading according to predefined strategies. Expert Advisors can be purchased at mql5.com or use their free versions.

- Deriv Trader:

- Binary Bot and Deriv Bot: Special tools for creating your own trading bots without the need to know programming languages. Binary Bot is an outdated model, while Deriv Bot is more functional and easy to use. The bot builder has ready-made blocks grouped by categories that can be used to customize the trading robot.

Deriv clients can also use ready-made bots to trade options using popular strategies such as Martingale, D’Alamber and Oscar Grind. The broker does not charge a fee for using these tools – the constructors and ready-made bots are provided free of charge.

Deriv Affiliate Program

1. CPA plan for EU residents (excluding Portugal and Spain):

- A partner receives a reward of $100 for each referred trader who deposits $100 to the trading account. It can be the sum of all deposits of the referral.

2. Deriv Prime:

- Liquidity offer for professional traders, B2B clients, brokerage companies and asset managers. Affiliate commission is 0.05%-0.055% for each million traded for cryptocurrencies and $5-$8 for other assets.

3. API:

- Technology to build your own trading infrastructure for yourself or your clients.

With more than 60,000 partners, Deriv programs are in high demand among private customers and businesses.

Safety guarantee

Deriv is a multi-regulated broker operating under licenses of such organizations as Labuan FSA, VFSC (Vanuatu), BVI FSC (British Virgin Islands). In the EU, Deriv’s services are provided under the supervision of Malta’s state regulator (MFSA).

Since June 2020, Deriv is a registered member of The Financial Commission, an international organization that settles disputes between brokers and traders. This organization has its own compensation fund, from which losses are reimbursed to clients of bankrupt financial companies. Each Deriv client can expect compensation of up to 20,000 euros in case the broker is unable to fulfill the payment of funds on its own.

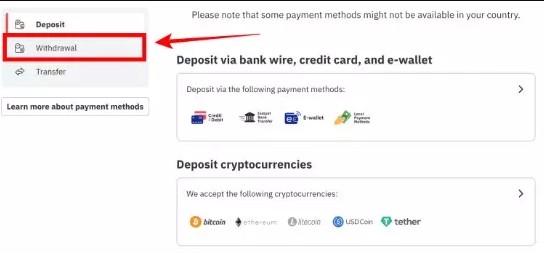

Withdrawal of funds in Deriv

Withdrawal requests are processed by the company within 1-3 business days. However, it should be taken into account that payment providers also need time to process the transaction. Exchanges through the DP2P system are made within 2 hours.

Clients from all countries can transfer profits to Visa and MasterCard. Other withdrawal methods depend on the client’s location. For example, residents of the Netherlands can use iDeal, Poland – Przelewy24, Germany – GiroPay.

The minimum amount for withdrawal varies depending on the method and is 5-10 EUR/USD/GBP. Withdrawal fees depend on the payment provider’s policy. Deriv processes requests without charging any fees.

Support service

Deriv provides 24/7 technical support for all clients, including unregistered traders.

Ways to get support:

- Via chat on the official Deriv website.

- In the messenger WhatsApp.

- In the Deriv user community.

Deriv has offices in 16 countries, where you can also get information about the broker’s services and tools.

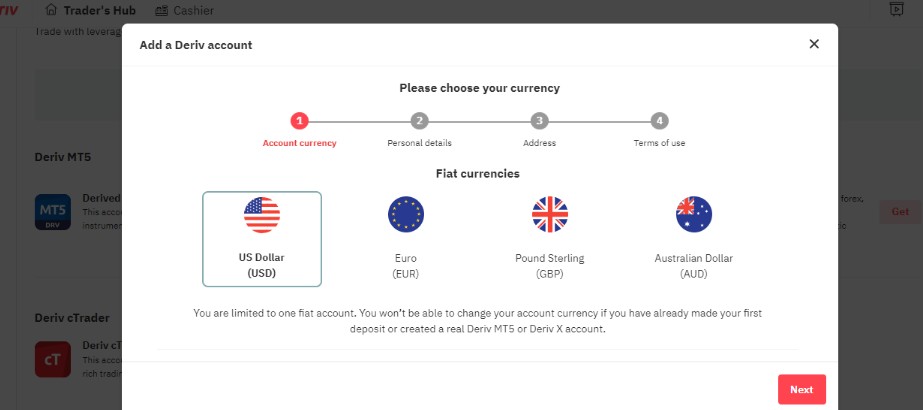

How to start trading with Deriv

Each Deriv client can open one account and choose the account currency. This is done in the personal cabinet after registration and verification. Account characteristics differ depending on the chosen platform and the intended trading tools.

Types of Accounts:

- Deriv MT5: Accounts for trading CFDs on currencies, stocks, ETFs, commodities with leverage, as well as transactions with CFDs on cryptocurrencies. The amount of leverage depends on the asset class.

- Deriv Trader: Accounts for options trading with a multiplier. More than 20 trading instruments with leverage up to 1:30 are available. The minimum bet is $5.

- Demo: Virtual trading account for practicing without using real money.

Deriv offers a variety of trading platforms, allowing traders to expand their capabilities and experience with financial instruments.

Advantages

- 24/7 support: Customers can get help any day of the week, including weekends, via live chat and WhatsApp.

- Wide range of CFDs: Access to a variety of markets and a large number of CFDs.

- Index trading: Possibility to trade stock and synthetic volatility indices.

- No service fees: No service fees for active trading accounts and provision of functional trading platforms.

- Diversity of payment systems: A wide range of payment systems and currencies for deposits and withdrawals, providing convenience for clients.

Overview of Deriv personal account

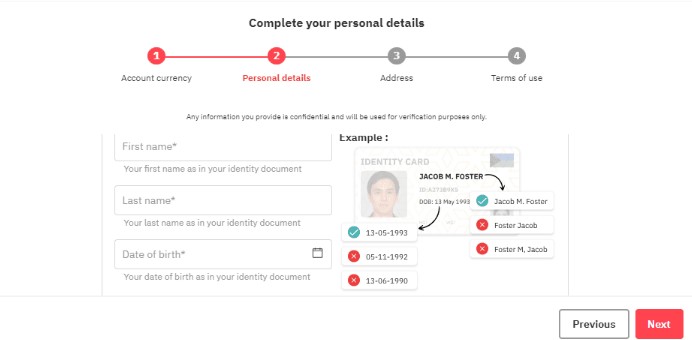

If you plan to start trading CFDs or options through a Deriv broker, you will need to create an account on their website. Here is a quick guide to creating an account:

Step 1: Start opening an account

The Deriv website does not have a separate button for opening an account. To start the registration process, click the “Log in” button and confirm your intention to create an account. The registration form will appear on the screen.

Step 2: Confirm email

The Company will prompt you to open a demo account and confirm your email. To do so, click on the link sent to your email address. Once verified, you will be able to easily switch between demo and live account with a single click.

Step 3: Actions in the account

After creating an account, a trader can perform the following actions:

- Account currency selection: Set the currency for your future trading account.

- Verification: Confirm your identity and residential address (mandatory step).

Additional account features:

- Financial transactions: Deposit and withdrawal of funds.

- Two-Factor Authentication: Connect and configure for added security.

- View Limits: Track account limits.

- Transaction History: View the history of logins and all transactions.

- transactions.

- Reports: Generating reports on open/closed positions and pending orders.

By following these steps, you will be able to create an account on the Deriv website and start trading CFDs and options.

Answers to questions

-

How to register on Deriv website and open a trading account

-

What trading platforms does Deriv offer

-

What types of accounts are available from Deriv

-

What deposit and withdrawal methods does Deriv support

-

How do I keep my Deriv account secure

-

What level of leverage is available on Deriv

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ