FXTM (ForexTime)

Collected complete information about all forex brokers, explore all their advantages and start earning mone

Open an accountFusion Markets, a new brokerage house from Australia, was founded in November 2017 and started actively providing its services in 2019. The company specializes in trading currency pairs and CFDs. The main office is located in Cremorne, a picturesque neighborhood of Melbourne, Australia. Fusion Markets is regulated by two important bodies: the Australian Securities and Investments Commission (ASIC) with license number 226199 and the Vanuatu Financial Services Commission (VFSC) with license number 40256.

-

Account currency

AUD, USD, EUR, GBP, JPY, CAD, SGD, THB

-

Minimum deposit

From $1

-

Leverage

Up to 1:30 (for retail accounts under ASIC regulation), up to 1:500 (for VFSC and Fusion Pro accounts under ASIC regulation)

-

Spread

From 0.8 points (Classic), from 0 points (Zero)

-

Tools

Currency pairs (80), CFDs on stocks (50), indices (12), metals (14), energy (3), cryptocurrencies (5)

-

Margin call / Stop out

90/20%

Pros

- Minimum Deposit: The company offers one of the most affordable minimum deposit sizes on the market - just $1, making trading accessible to a wide range of investors.

- Trading platforms: Traders have access to both desktop and mobile versions of MetaTrader 4 and MetaTrader 5 platforms, as well as a web terminal, which provides flexibility and convenience in trading.

- Trade Copying Services: Fusion Markets supports passive investing through trade copying services, allowing clients to automatically copy the strategies of successful traders.

- Low trading commissions: The broker offers competitively low trading commissions as well as no deposit fees, reducing trading costs for clients.

- Multilingual support: Customers can benefit from support through multiple communication channels, including chat, email and phone, making service more accessible and efficient.

- Quick registration and user-friendly interface: The registration process in Fusion Markets is quick and easy, and the interface of the trader's personal cabinet is intuitive and easy to use.

Minuses

- Limited range of trading instruments: Unlike some competitors, Fusion Markets does not offer the ability to trade actual stocks, futures or options, limiting traders to a standard set of instruments such as currencies and CFDs.

- Lack of educational materials: The broker's website does not provide educational information or author's analytics, which can complicate the start of work for beginners and reduce informational support for experienced traders.

- Vanuatu Regulation: Although the broker is regulated by other, more reputable bodies like ASIC, its unit operating under the jurisdiction of Vanuatu may raise concerns due to less stringent regulatory standards and reliability in that jurisdiction.

Customer geography

-

Australia 18.67%

Australia 18.67% -

United Kingdom 17.69%

United Kingdom 17.69% -

Kenya 8.85%

Kenya 8.85% -

Canada 8.41%

Canada 8.41% -

Romania 7.45%

Romania 7.45% -

Philippines 6.85%

Philippines 6.85% -

United States 6.14%

United States 6.14% -

France 5.09%

France 5.09% -

Belarus 4.81%

Belarus 4.81% -

China 4.73%

China 4.73% -

Others 33.31%

Others 33.31%

Expert evaluation

Fusion Markets is an ambitious player in the brokerage services market, successfully positioning itself in the niche of low-cost brokers. Since its inception, the company has established itself by providing low-cost services through regulation by ASIC (Australian Securities and Investments Commission).

Fusion Markets is part of Gleneagle Asset Management (GAML), a subsidiary of Gleneagle Securities. Founded in 2010, Gleneagle provides asset management and corporate advisory services. Thanks to Gleneagle’s strong relationships with liquidity providers, Fusion Markets offers clients favorable trading conditions.

Fusion Markets has two types of trading accounts in its portfolio: Classic and Zero. The Zero account offers more favorable conditions for active traders, with a commission of $4.50 per round of trading and spreads starting at 0 pips. For those who prefer a simpler solution without separate commissions, the Classic account includes commissions in spreads starting at 0.8 pips. This makes the Zero account more preferable for those who engage in active trading.

Analysis

Ribeit

Rebate from MOFT is an effective way to reduce brokerage commissions. To get started, you need to register on the Traders Union website, open an account through the referral link of this association and start trading. This will allow you to receive a part of the spread rebate for all executed transactions on the Forex market, regardless of whether the trades were profitable or unprofitable. Thus, the rebate is available for Fusion Markets clients who follow this procedure.

Rebate details: In case of a Classic account with Fusion Markets, the company pays 0.4 pips per lot to MOFT. MOFT clients, in turn, receive 80% of this amount.

Example of rebate calculation: Let’s assume that you have been trading EUR/USD on the Classic account at Fusion Markets for a month. The total volume of your trades amounted to 10 lots. You paid a spread of $10 for each lot, totaling $100. Fusion Markets pays MOFT $4 for each lot, totaling $40 for 10 lots. Of this amount, you will receive 80%, or $32.

Trading condition

Fusion Markets provides its clients with a limited selection of trading instruments through the popular MetaTrader trading platforms. Traders can take advantage of different leverage levels, which range from 1:30 for accounts regulated in Australia to 1:500 for accounts under the jurisdiction of Vanuatu. To assess the quality of the broker’s services, there is an option to open a demo account.

At the moment, Islamic accounts that avoid swap charges are not available for Muslim traders. However, Fusion Markets is actively working to introduce this option and promises to notify clients as soon as it becomes available. This demonstrates the broker’s commitment to expanding its services and adapting to the diverse needs of its clients.

-

Trading platform

МТ4 (Desktop, Mobile, Web), МТ5 (Desktop, Mobile), WebTrader

-

Accounts

Demo, Classic, Zero

-

Account currency

AUD, USD, EUR, GBP, JPY, CAD, SGD, THB

-

Deposit/withdrawal

Visa/Mastercard, bank transfer, Skrill, Neteller, Fasapay, Jeton Wallet, Perfect Money, PayPal (not available for all countries)

-

Minimum deposit

From $1

-

Leverage

Up to 1:30 (for retail accounts under ASIC regulation), up to 1:500 (for VFSC and Fusion Pro accounts under ASIC regulation)

-

PAMM accounts

yes

-

Minimum order

0,01

-

Spread

From 0.8 points (Classic), from 0 points (Zero)

-

Instruments

Currency pairs (80), CFDs on stocks (50), indices (12), metals (14), energy (3), cryptocurrencies (5)

-

Margin call / Stop out

90/20%

-

Liquidity provider

Unnamed partners of the parent company Gleneagle Securities

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Execution

-

Trading features

There is no fee for inactivity on the account. To remove the 30-day limitation on using a demo account, you need to fund a live account with 10 dollars

-

Contests and bonuses

Bonus for attracting a client

Commissions

MOFT specialists conducted a detailed analysis of ForexTime (FXTM) trading conditions in order to identify trading and non-trading commissions. The results of the analysis showed that the company has no hidden commissions. No commission is charged for replenishment of the trading account. However, the withdrawal fee is set by payment systems and varies from 0.5% of the withdrawal amount to a maximum of 30 EUR.

On Advantage accounts, spreads start from 0.0 pips, which provides traders with excellent trading conditions. At the same time, traders are charged a commission for each lot, which ranges from $0.4 to $2, depending on the volume of the transaction. There is also a fixed commission for transferring orders to the next day (swap), which is a standard practice in the Forex market.

Broker Overview

Fusion Markets has established itself as a broker strictly adhering to three main principles: providing competitive prices, freedom in choosing trading strategies and providing responsive customer support. The company guarantees Market Execution and allows the use of automated trading systems. In the Client Cabinet, traders have access to free trading ideas from Trading Central.

Fusion Markets broker key metrics:

- Spreads: start from 0 pips.

- Asset range: more than 170 assets for trading.

- Commissions: 36% lower compared to major competitors.

Fusion Markets works closely with Gleneagle Securities, which manages over $273 million in assets. Thanks to the partnership with Gleneagle Securities and connections with liquidity providers, the broker offers its clients the opportunity to trade on favorable conditions with minimum spreads and commissions. Clients can work with currency pairs, as well as CFDs on stocks, indices, metals, cryptocurrencies and energy resources.

Additional Customer Opportunities:

- Social Trading: Fusion Markets offers access to DupliTrade and MyFxBook Autotrade platforms to create passive income or enhance the profitability of existing trading strategies.

- Trading platforms: Clients can trade via desktop and mobile versions of MetaTrader 4 and MetaTrader 5, which support one-click trading, EAs and custom scripting.

Useful services from Fusion Markets:

- VPS: Virtual Private Server for continuous operation of automated strategies.

- Sentiment and Market Buzz: Tools for analyzing market sentiment.

- Trading Calculators: Tools for calculating potential profits, losses, margins and swaps.

- Economic Calendar: Tracking of key economic events and statistics.

- Trading ideas: Suggestions from Trading Central’s team of professionals.

Fusion Markets offers two types of trading accounts – Classic and Zero, each of which is focused on specific requirements of traders. Clients can request a change of account type by contacting the support team.

Description of account types:

- Classic: This is a standard account with floating spreads. For example, the spread on EUR/USD starts from 0.8 pips. This account is suitable for traders who prefer traditional trading conditions without additional commissions.

- Zero: This account is designed for more experienced traders, offering spreads from 0 pips. The commission per lot is 4.50 AUD, a rate that has not changed despite AUD/USD fluctuations. This account is ideal for those looking for low spreads and a transparent commission structure.

Demo account in Fusion Markets is available for a period of 30 days. In order to use a demo account without time limits, you need to deposit at least 10 dollars into your real account.

Bonuses from Fusion Markets:

- Fusion Markets does not offer bonuses for funding the account. Traders use only their own funds in trading. However, the broker provides the “Bring a Friend” program, under which you can get a bonus on your account or benefits on commissions for attracting an active client. It is recommended to check the details and terms of this program with the support service.

Fusion Markets acts as a low-cost broker, providing favorable conditions for active trading in global markets, which makes it an attractive choice for a wide range of investors.

Fusion Markets provides ample opportunities for both active traders and those who prefer passive earnings. Clients can choose between two main account types – Classic and Zero, and can also change the account type through a support request.

Description of account types:

- Classic: This is a standard account with floating spreads starting at 0.8 pips for EUR/USD, suitable for most traders.

- Zero: This account is aimed at professional traders with spreads starting from 0 and a fixed fee of 4.50 AUD per transaction, which remains unchanged despite currency fluctuations.

To evaluate the broker’s services without risk, clients can use a demo account available for 30 days. Unlimited access to the demo account requires funding a real account with a minimum of 10 dollars.

Investment Programs:

- Multi Account Manager (MAM/PAMM): Suitable for experienced traders wishing to manage investor funds. Requirements include a minimum deposit of $5,000, three months of profitable trading statistics and a minimum of three clients.

- Copy-trading: Myfxbook AutoTrade and DupliTrade services allow you to automatically copy trades of successful traders. These platforms have strict criteria for selecting managers, which ensures a high probability of profitability of the selected strategies.

Fusion Markets Affiliate Programs:

- IB Partner: For companies wishing to receive commission for referring clients. Participation begins with the referral’s first transaction.

- Invite a Friend: Offers a $50 bonus for both referred and new clients, which makes this program attractive to current users of the broker who wish to recommend it to their friends.

Fusion Markets strives to offer traders favorable conditions for trading and investing, as well as a variety of ways to earn passive income in the financial markets.

Withdrawals from Fusion Markets are governed by strict regulations to ensure the safety of financial transactions. Here are the main aspects of the withdrawal process:

Basic rules of inference:

- Withdrawal method: Funds can be withdrawn only by the method used to deposit them. Withdrawal to third party accounts is strictly prohibited.

- Available methods: Clients can withdraw funds via bank transfer, Visa and Mastercard credit/debit cards and Skrill and Neteller electronic payment systems.

Processing withdrawal requests:

- Requests received before 11:00 a.m. AEDT time on weekdays are processed the same day. Requests received after that time are processed the next business day.

- The timeframe for receiving funds varies: 1-5 business days for credit and debit cards and 2-5 business days for wire transfers, depending on your bank or financial intermediary.

Commissions and Restrictions:

- Fusion Markets does not charge a withdrawal fee. However, banks and financial intermediaries may charge a fee of 15 to 25 dollars for wire transfers, which causes a minimum withdrawal amount of 30 dollars via wire transfer (except for Australian residents).

- Withdrawals to credit and debit cards are commission-free through the refund process. Withdrawals via Skrill and Neteller are also carried out without commissions.

Verification:

- To be able to withdraw funds, you need to go through the account verification process.

Customer Support:

- The support team is available around the clock from 06:00am AEDT Monday to 07:00am Saturday morning, which corresponds to Forex trading hours.

These rules ensure the transparency and security of financial transactions for Fusion Markets customers.

Advantages

- Variety of trading instruments: Clients have access to six asset classes for trading, including currencies, metals, energy, cryptocurrencies, stock indices and equities. This provides traders with flexibility and the ability to diversify their investment portfolio.

- Segregated accounts for security of funds: All client funds are held in segregated accounts in accordance with the strict requirements of Australian regulator ASIC, ensuring their safety.

- Competitive Fees: Fusion Markets offers some of the lowest commissions and spreads in the industry. In addition, the broker does not charge additional deposit and withdrawal fees, which reduces overall trading costs for clients.

- Automatic trade copying: For investors interested in passive earnings, automatic trade copying strategies are available through the DupliTrade and MyFxBook Autotrade platforms. This allows clients to easily replicate successful strategies of experienced traders.

- Intuitive client interface: Fusion Markets' user-friendly and functional client cabinet provides easy access to all necessary trading tools and account management, making the trading process as simple and efficient as possible.

Fusion Markets Personal Account Overview

Creating a personal account on the Fusion Markets website is a quick and convenient process.

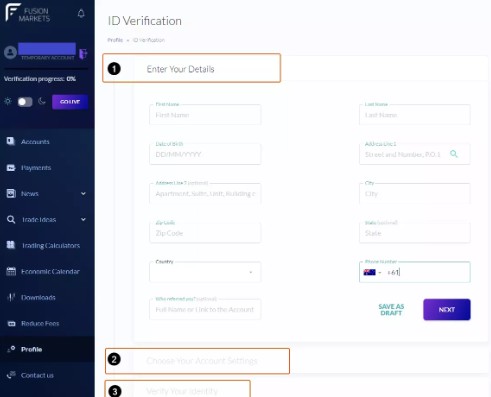

- Registration:

- On any page of the site, locate and click the “Create An Account” button.

- Fill out the standard registration form or use the quick registration function through your Google account to create an account in one click.

- Cabinet activation:

- After registration, you will get access to your personal cabinet, where you can create a demo account and familiarize yourself with Trading Central’s analytics. All sections of the cabinet are available through the left vertical menu.

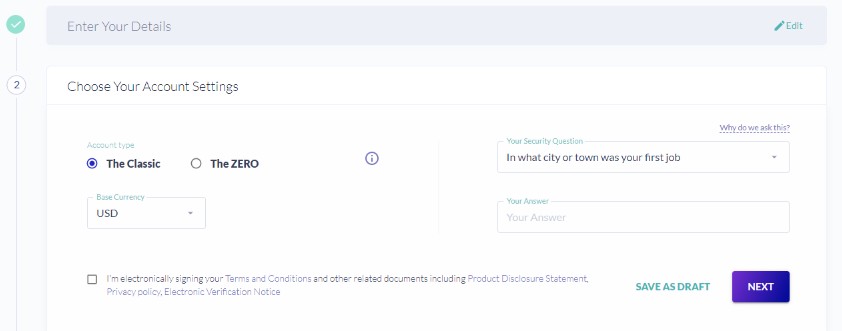

- For full access to the functionality, including opening a live account and deposit and withdrawal operations, it is necessary to pass the ID Verification process.

- Verification process for accounts in the jurisdiction of Vanuatu:

- Step 1: Enter basic personal information (full name, date of birth, country of residence, address and phone number).

- Step 2: Select your account type and base currency, confirm that you agree to the terms of use and ask a secret question and answer for added security.

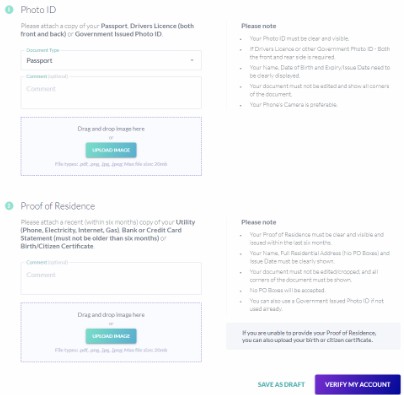

- Step 3: Upload scans or photos of documents proving your identity and residential address.

After sending a verification request, the broker usually responds within one business day.

Additional features in myAlpari:

- Possibility to contact the broker’s representative.

- Form for changing personal data.

- Overview of account information, transaction history, deposit and withdrawal statistics.

- Access to trading ideas and current news.

- Economic calendar and trading calculator.

- Links for downloading trading platforms.

This simple and intuitive registration process makes Fusion Markets accessible to traders of all experience levels.

Answers to questions

-

What types of accounts does Fusion Markets offer?

-

How can I fund my trading account?

-

What are the verification requirements at Fusion Markets?

-

Can I trade cryptocurrencies on Fusion Markets?

-

What security measures does Fusion Markets employ to protect client funds?

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ