FXTM (ForexTime)

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountFXTM Brokerage Company, also known as Forex Time, started its operations in 2011, offering its clients a wide range of opportunities for active trading and participation in investment programs. The company is regulated by several reputable authorities, including the Financial Sector Supervisory Authority of South Africa (FSCA) with license number 46614, the British Financial Conduct Authority (FCA) with license number 777911 and the Mauritius Financial Supervisory Commission (FSC) with registration number C113012295. FXTM has won many prestigious awards over the years, including recognition for “Best Trading Environment” in 2018 and 2019, as well as “Most Innovative Broker” in 2018.

More than two million traders around the world choose FXTM as their broker of choice. The minimum deposit for a Micro account is only $10, making it accessible to beginners who want to learn the basics of Forex trading without significant financial risks.

-

Account currency

USD, EUR, GBP, NGN

-

Minimum deposit

$10

-

Leverage

1:30 - 1:2000

-

Spread

From 0.0 points

-

Tools

Currency pairs, precious metals, CFD contracts on stocks, on commodities, on indices

-

Margin call / Stop out

40-60%; 50/80%

Pros

- Variety of trading accounts: FXTM offers a wide range of accounts, which allows traders to choose the best conditions for their trading strategies.

- Extensive educational materials: The broker provides traders with a large number of educational resources that contribute to their professional development.

- Support for automated trading: FXTM enables the use of automated trading programs, which expands trading opportunities for clients.

- Available Minimum Deposit: With a minimum deposit of just $10, FXTM makes forex trading accessible to a wide range of investors.

- Popular trading platforms: MT4 and MT5 are the two most popular trading platforms offered by the broker, providing a high level of functionality and user-friendliness.

- FXTM Trader Mobile App: FXTM Trader's proprietary mobile trading app improves the accessibility and usability of the broker's services.

- Ultra low spreads: Spreads starting from 0.0 pips allow clients to reduce trading costs.

- Rich choice of trading instruments: A wide range of instruments opens up opportunities for traders to diversify their investment portfolios.

- Strict regulatory control: The broker is regulated by major financial authorities in four jurisdictions, which ensures a high level of trust and security.

- Professional support service: Experienced specialists are always ready to help clients with any questions related to trading and using the company's services.

Minuses

- Limited investment options: FXTM only offers a trade copying service for investing, which may limit investors who wish to diversify their strategies through other investment vehicles such as PAMM accounts or investment funds.

- No trading on weekends: The company does not provide the ability to trade on Saturday and Sunday, which can be a disadvantage for traders looking to capitalize on the opportunities in the cryptocurrency market, which is traded 24/7.

Customer geography

-

Nigeria 10.62%

Nigeria 10.62% -

Afghanistan 9.33%

Afghanistan 9.33% -

Vietnam 8.41%

Vietnam 8.41% -

Algeria 5.08%

Algeria 5.08% -

India 4.65%

India 4.65% -

South Africa 4.4%

South Africa 4.4% -

United States 4.24%

United States 4.24% -

Egypt 4.14%

Egypt 4.14% -

Thailand 4.03%

Thailand 4.03% -

Malaysia 3.92%

Malaysia 3.92% -

Others 52.18%

Others 52.18%

Expert evaluation

FXTM, also known as Forex Time, has been cooperating with MOFT for several years, successfully fulfilling its obligations as a reliable partner. The company offers a wide range of trading accounts adapted for both beginners and experienced traders, while providing optimal trading conditions. FXTM has also developed a rating system that evaluates managers according to various criteria, including risk level.

The company attracts both beginners and professional traders who create their own strategies. According to user reviews, FXTM support service promptly solves all arising issues, maintaining a high level of customer service. The broker’s website allows you to quickly familiarize yourself with the conditions for active trading and available investment programs.

Despite a number of advantages, some aspects, such as delays in withdrawals and a limited selection of investment programs, temporarily limit FXTM’s ability to rank higher in the MOFT rankings. Nevertheless, FXTM maintains its status as a proven broker in demand among MOFT clients, offering minimum investments to get started and the innovative FXTM Invest service for copying trades, which allows investors to earn passive income.

Analysis

Ribeit

Cooperation with MOFT rebate service provides FXTM clients with an opportunity to reduce trading costs. To do this, you need to register on the MOFT website, open an account with FXTM broker through the MOFT referral link and start receiving rebates for all trades executed. Users who actively participate in the FXTM Invest trade copying service are also eligible for rebate payments.

Remuneration structure of the ITF:

- For each lot on Micro account: from 5 USD.

- On Advantage account: from 10 US dollars of commission.

- MOFT clients receive 80% of these amounts.

Example of rebate calculation: Suppose you trade 1 lot per day on EUR/USD, where 1 lot equals 100,000 units of the base currency. The pip cost for such a lot is 10 USD and the spread is 1 pip. If you were to trade directly through FXTM, your spread costs would be $10 per day. Taking into account the MOFT rebate for the Micro account of $5 per lot, 80% of which is transferred to the trader, you would receive a compensation of $4.

Trading conditions

FXOpen offers attractive trading conditions that are suitable for both beginners and experienced traders. The company offers a variety of account types, each of which offers certain advantages, including accounts with the ability to use significant leverage. For example, the Micro account with a minimum deposit of only 1 dollar provides ideal conditions for beginner traders. In addition, the broker offers demo accounts with virtual funds to study trading conditions and terminal functions.

All account types allow hedging and the use of expert advisors. ECN and STP accounts support scalping, news trading and telephone dealing. The Micro account allows you to trade 28 currency pairs as well as gold and silver, while the STP and ECN accounts provide access to 50 currency pairs, CFDs and indices. The Crypto account focuses exclusively on cryptocurrency trading.

FXOpen accounts are characterized by a floating spread starting from 0.0 pips, which is especially attractive for automated trading via MyFXbook and ZuluTrade systems. A special no-wap account is available for Muslim traders who participate in trading currencies, metals and CFDs.

The company regularly organizes contests for its clients and provides a rich assortment of information resources, including economic news, analytical reviews and a calendar of economic events on the official website. FXOpen clients can also receive detailed reports on their account status at the end of each trading day and month.

-

Trading platform

MetaTrader 4, MetaTrader 5, FXTM Trader

-

Accounts

Micro, Advantage, Advantage Plus

-

Account currency

USD, EUR, GBP, NGN

-

Deposit/withdrawal

Visa/MasterCard, electronic payment systems, bank transfer

-

Minimum deposit

$10

-

Leverage

1:30 - 1:2000

-

PAMM accounts

no

-

Minimum order

0,01

-

Spread

From 0.0 points

-

Instruments

Currency pairs, precious metals, CFD contracts on stocks, on commodities, on indices

-

Margin call / Stop out

40-60%; 50/80%

-

Liquidity provider

-

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Instant Execution, Market Execution

-

Trading features

Stock trading, VPS server, income and pips calculators, currency converter, MT4 indicators

-

Contests and bonuses

yes

Commissions

MOFT specialists conducted a detailed analysis of ForexTime (FXTM) trading conditions in order to identify trading and non-trading commissions. The results of the analysis showed that the company has no hidden commissions. No commission is charged for replenishment of the trading account. However, the withdrawal fee is set by payment systems and varies from 0.5% of the withdrawal amount to a maximum of 30 EUR.

On Advantage accounts, spreads start from 0.0 pips, which provides traders with excellent trading conditions. At the same time, traders are charged a commission for each lot, which ranges from $0.4 to $2, depending on the volume of the transaction. There is also a fixed commission for transferring orders to the next day (swap), which is a standard practice in the Forex market.

Broker Overview

FXTM, a brokerage company with a global reach, offers its services in 150 countries. The broker relies on innovative technologies to accelerate order execution, allowing traders to work with currency pairs, precious metals, as well as CFDs on indices and shares of global and European companies.

Key Facts about FXTM:

- Experience in the Forex market for more than 10 years.

- Operations in 150 countries with more than 2 million clients.

- The minimum deposit is only $10.

- More than 25 international awards confirm the high status of the company.

- 84% of withdrawal requests are processed in less than 5 minutes.

FXTM strives to provide traders with optimal trading conditions and high-quality support. The company offers different types of accounts: Micro for beginners and Advantage and Advantage Plus for experienced professionals. Micro accounts provide instant execution of orders, while accounts for professionals use market execution with an average transaction speed of 0.1 seconds.

Trading platforms and tools:

- MetaTrader 4 and MetaTrader 5 are available for mobile devices, allowing traders to trade on the device of their choice.

- The FXTM Trader app enhances mobile trading with its convenience and functionality.

FXTM’s value-added services include:

- Point and income calculators.

- Currency Converter.

- Indicators for MetaTrader 4.

- Possibility to trade Forex using VPS to increase the speed and reliability of operations.

FXTM offers a variety of account types adapted for both novice traders and experienced professionals. Each account differs in terms of minimum deposit, leverage, available trading assets, margin call and stop out levels, and order execution type.

FXTM trading account options:

- Micro:

- Suitable for beginners and traders testing new strategies.

- Minimum deposit: $10.

- Leverage: up to 1:30.

- Spread: from 1.5 pips.

- Order execution: Instant Execution.

- Available trading platform: MT4.

- Advantage:

- Ideal for more experienced traders.

- Minimum deposit: $500.

- Leverage: up to 1:30.

- Spread: starts from 0.0 pip; commission for trades varies from $0.4 to $2.

- Order execution: Market Execution.

- Available platforms: MT4 and MT5.

- Swap-Free is available on MT4.

- Advantage Plus:

- Minimum deposit: $500.

- Available account currencies: USD, EUR, GBP.

- Trading instruments: Forex, metals, stocks, indices.

- Spread: from 1.5 pips.

- Order execution: Market Execution.

- Swap-Free service is available.

- Margin Call: 80%, Stop Out: 50%.

Additional features:

- Demo Account: Provided to test trading conditions and strategies without risk.

- Mobile App: FXTM Trader improves the accessibility and convenience of mobile trading.

Bonuses and loyalty program:

- The FXTM loyalty program offers cashback up to $5 per trade, with tiers that increase the reward depending on the trader’s activity. Accruals occur weekly and can be used for both trading and withdrawals.

FXTM focuses on cooperation with traders of different experience levels, offering conditions that satisfy both beginners and veterans of the foreign exchange market.

Forex Time (FXTM) offers a variety of investment programs aimed at both active traders and those who prefer passive trading. One of the key offerings for passive income is the FXTM Invest trade copying service, which allows investors to earn money by copying the strategies of successful traders.

The main features of FXTM Invest:

- Trader selection: Investors can select traders to copy trades based on profitability, trading style and risk profile using a special filter in the rating.

- Diversification: It is possible to copy trades of several managers simultaneously, which allows minimizing risks and increasing the efficiency of investment strategy.

- Rating relevance: The managers’ rating is updated automatically and provides up-to-date statistics on key indicators.

Traders can become managers at FXTM Invest, allowing others to copy their trades and earn additional income for doing so. This creates opportunities for professional traders to monetize their strategies.

Investor Program:

- Available strategies: More than 5000 trading strategies are available for copying.

- Minimum investment: You can start with $100.

- Payment terms: Commission is charged only for profitable trades, which makes investing more attractive.

FXTM ‘Refer a friend’ affiliate program:

- Remuneration: Partner receives $50 for each referred client.

- Terms: Any FXTM trader with an open account can become a partner. An individual referral link is provided in myAlpari to attract new clients.

- Bonuses: Partners are rewarded for the activity of each attracted client, which stimulates the expansion of the client network.

FXTM is committed to providing flexible and favorable conditions for both traders and investors, contributing to the development of their financial potential.

Withdrawal of funds at FXTM

To initiate the withdrawal process at FXTM, traders must submit an application, which is processed by the financial department from 6 a.m. to 8 p.m. GMT+2, and GMT+3 during summer time. The withdrawal fee depends on the selected payment system.

Available withdrawal methods include:

- Bank cards: Maestro, Visa, MasterCard.

- Electronic payment systems: Skrill, Neteller, Dotpay.

- Bank transfer via Hellenic Bank.

Withdrawal processing time is up to 24 hours for bank transfers and several business days for transactions with cards and electronic systems.

Currencies for withdrawal and deposit:

- EUR, INR, USD, GBP, PLN, NGN, CZK.

Account Verification: To be able to withdraw earned funds, a trader needs to verify his account.

Support: In case of questions or problems, traders can contact FXTM’s multi-lingual support team, which is available 24 hours a day, Monday through Friday (24/5).

Advantages

- Optimal leverage: We offer leverage to suit the needs of beginners and experienced traders alike, providing flexibility in strategy selection.

- Automated Trading: Our platform supports the use of automated trading systems, allowing traders to maximize their trading opportunities.

- Segregated accounts for client funds: We guarantee the safety of client funds by keeping them in segregated accounts, which minimizes financial risks.

- Multilingual Personal Managers: Each client has access to a personal manager who speaks their language, which simplifies communication and improves service quality.

- Indicators for MetaTrader 4: We provide a wide range of indicators for MT4, improving traders' analytical capabilities.

- Trading using VPS: Traders can use virtual private server (VPS) services, which provides more stable and faster order execution.

- Financial regulator: Our activities are regulated by reputable financial authorities, which confirms our reliability and transparency of business processes.

FXTM Personal Account Overview

To start trading with FXTM, you need to follow a few simple steps:

- Account Opening:

- Go to the main page of the official FXTM website and click on the “Open an account” button.

- Registration:

- Fill out the registration form by entering personal data and creating a password to access your account. After completing the form, a PIN code will be sent to your email and phone number, which will be required to complete the registration.

- Profile Completion:

- Complete your profile with pertinent information including date of birth, city, full address, and funding source.

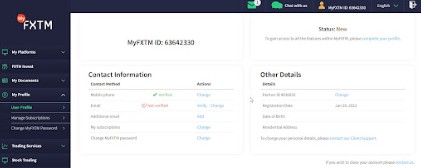

- Access to My Account:

- After registration, you will get access to the Personal Cabinet, where you can:

- Open a trading account and customize it according to your preferences.

- Perform financial operations, such as deposit, withdrawal and transfer of funds between accounts

- After registration, you will get access to the Personal Cabinet, where you can:

Additional functions in myAlpari:

- Platforms: Download MT4, MT5 and FXTM Trader trading terminals, access to web terminal.

- FXTM Invest: Investment management, opening a trading account, access to manager statistics.

- My Documents: Upload necessary documents for account verification.

- My Profile: Manage profile settings, subscriptions and passwords.

- Trading Services: Access to trading signals and indicators for MT4.

- StocksTrading section: Advantage Plus account opening for trading on the world’s largest stock exchanges via MT5.

- Promotions and Contests: Information about current promotions, bonus programs and contests.

- Education: Access to webinars and seminars, as well as an e-book.

- Customer Support: Options for contacting customer support for various issues.

These steps will help you easily get started in the world of forex with FXTM by taking advantage of all the tools and resources available.

Answers to questions

-

How to register and open a trading account with FXTM?

-

What types of accounts are available with FXTM?

-

What deposit and withdrawal methods are available at FXTM?

-

What trading platforms does FXTM provide?

-

How do I contact FXTM support team?

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ