Darwinex

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountDarwinex has been successfully operating as a broker and asset management company since 2012. The company is regulated in the UK (FCA) and Spain (CNMV), participates in investment insurance schemes and holds client funds in major EU banks. Darwinex offers ECN accounts on MT4 and MT5 platforms for forex trading, as well as CFDs on indices, metals, energy, stocks and US ETFs.

Integration with Interactive Brokers provides traders with access to the futures and real equity markets using advanced Trader Workstation (TWS) software. Traders in the US and Canada, although CFD trading through Darwinex is not available, are given the opportunity to participate in the Darwinex Zero capital allocation program.

These measures provide Darwinex with a high degree of reliability and a variety of trading opportunities for traders around the world.

-

Account currency

EUR, USD, GBP

-

Minimum deposit

$500

-

Leverage

Up to 1:30 (Retail) Up to 1:200 (Professional)

-

Spread

From 0.0 point

-

Tools

CFDs on Forex, Commodities, Indices, Stocks (US), ETFs (US) Futures, Real Stocks and ETFs through Interactive Brokers

-

Margin call / Stop out

100%/50%

Pros

- Licensing by reputable regulators: The broker is regulated by the British FCA and Spanish CNMV, which ensures a high level of trust and reliability.

- Protection of client funds: Client funds are protected from misuse and bankruptcy by Darwinex, increasing the security of the investment.

- Wide range of trading instruments: Clients have access to more than 950 CFDs and over 500 exchange-traded assets offered through a partnership with Interactive Brokers.

- Competitive trading conditions: Darwinex offers floating spreads and low commissions per lot, which makes trading more profitable.

- Reduced Commissions and Rebate: Traders with successful trading strategies can receive reduced commissions, and clients with Professional status can receive rebates.

- Advanced trading platforms: Ability to trade CFDs, including currency pairs, through MetaTrader 4 and MetaTrader 5 platforms.

- Minimum thresholds for asset management: Experienced traders can manage funds starting from 200 USD/EUR/GBP, which makes Darwinex services accessible to a wide range of investors.

Minuses

- High minimum deposit: The minimum deposit to open an account is 500 USD/EUR/GBP, which can be a high threshold for beginning traders.

- Lack of some account types: The company does not have accounts without lot fees, cent accounts for beginners, and Islamic accounts without swaps, which may limit accessibility for certain categories of traders.

- Limited options for cryptocurrency trading: Darwinex does not support cryptocurrency transactions and does not offer trading of digital assets, which can be a drawback for traders interested in this fast-growing market.

Customer geography

-

Spain 41.33%

Spain 41.33% -

Colombia 6.72%

Colombia 6.72% -

Mexico 4.41%

Mexico 4.41% -

Brazil 1.77%

Brazil 1.77% -

Benin 1.23%

Benin 1.23% -

Peru 0.99%

Peru 0.99% -

Malaysia 0.8%

Malaysia 0.8% -

Chile 0.74%

Chile 0.74% -

China 0.9%

China 0.9% -

India 0.5%

India 0.5% -

Germany 0.3%

Germany 0.3% -

Others 24.71%

Others 24.71%

Expert evaluation

Darwinex is a regulated broker providing access to derivatives markets with competitive commissions and a wide range of trading instruments. Using ECN technology, the broker connects its clients directly with liquidity providers, which allows it to achieve virtually zero spreads and minimal delays in the execution of trades. However, ECN accounts charge an additional commission per lot.

Types of Accounts and Deposits:

- Minimum deposit: For individual and joint accounts – 500 USD/EUR/GBP, for corporate accounts – 10 000 USD/EUR/GBP.

- Replenishment: Further replenishments from 100 USD/EUR/GBP via cards and electronic systems are possible. The minimum deposit amount by bank transfer is 500 USD/EUR/GBP.

Funds Management: When a client deposits funds, they are deposited into the Darwinex account wallet. These funds can be allocated between trading and investment accounts.

Features and Opportunities: Darwinex aims to empower both active traders and investors. The company has created a managed capital ecosystem with a turnover of over 140 million dollars. The rules of investment programs are regularly improved. For example, in 2023, the DarwinIA seed capital program was modernized, making it more accessible and progressive for non-professional traders.

Limitations: Darwinex does not offer STP and Islamic accounts, which may be a disadvantage for certain traders.

These features make Darwinex an attractive choice for traders and investors looking for a reliable broker with a variety of tools and competitive terms.

Analysis

Trading condition

The maximum leverage provided by Darwinex depends on the asset class and client status: retail traders can use leverage up to 1:30 and professional traders up to 1:200. The broker does not offer Islamic accounts (without swap).

Darwinex provides ECN accounts with floating spreads and competitive commissions per lot. The wallet currency is set at account creation and all subsequent accounts will be automatically opened in that currency. It is not possible to change or add another currency after account creation.

-

Trading platform

MetaTrader (МТ4 и МТ5), DARWIN API, FIX

-

Accounts

Demo, Retail, Professional, Darwin IBKR account (stock trading account)

-

Account currency

EUR, USD, GBP

-

Deposit/withdrawal

Bank transfer, credit and debit cards Mastercard, VISA and VISA Electron, Skrill

-

Minimum deposit

$500

-

Leverage

Up to 1:30 (Retail) Up to 1:200 (Professional)

-

PAMM accounts

no

-

Minimum order

0,01

-

Spread

From 0.0 point

-

Instruments

CFDs on Forex, Commodities, Indices, Stocks (US), ETFs (US) Futures, Real Stocks and ETFs through Interactive Brokers

-

Margin call / Stop out

100%/50%

-

Liquidity provider

no data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Еxecution

-

Trading features

Variable spreads, algorithmic trading allowed

-

Contests and bonuses

Rebate Scheme for professional clients, Pricing Discounts for wealth managers

Commissions

Darwinex provides retail and professional traders with ECN accounts with floating spreads starting from 0.0 pips. A typical EURUSD spread is 0.3 pips. The commission per lot for Forex is 2.5 units of the base currency in each direction, which means that a trader pays 5 euros for 1 closed lot on EURUSD.

Commissions per lot for other assets:

- Indexes: $0.275 to $2.75.

- Commodities: 0.0025% of the order value.

- Stocks and ETFs: $0.02 per 1 contract.

Professional clients trading large volumes can get discounts on lot commissions and pay from $1.5 per order.

Additional fees:

- Depositing by bank transfer: A fee of $5/€/£ will be charged for deposits under $500/€/£.

- Deposits via Skrill: The fee is 0.5% of the amount.

- Deposits less than $2000: The bank may charge additional fees.

- Withdrawal by bank transfer: Fees vary from £0 to £15 depending on the country receiving the payment.

Swap Commissions:

- The rollover fee is calculated for all positions opened after 17:00 New York time.

- Triple swaps are applied on Wednesdays (for USDCAD and USDTRY pairs – on Thursdays).

These conditions make Darwinex an attractive choice for traders looking for low spreads and competitive commissions when trading a variety of assets.

Broker Overview

Darwinex partners with trusted liquidity providers and tier 1 banks in Spain. All servers, including liquidity providers’ servers, Darwinex’s MetaTrader trading servers and VPS from BeeksFX provider, are located in the Equinix LD4 data center in London. This ensures the highest possible data transfer speed, which is especially important for brokers using ECN technology. Retail clients are protected from negative balances, which helps limit losses when trading with leverage.

About Darwinex broker in numbers:

- More than 11 years of experience in financial markets.

- Regulated by two bodies (FCA in the UK and CNMV in Spain).

- Up to €100,000 compensation per client in case of bankruptcy.

- Over 950 CFDs.

- Over $140 million dollars under management.

Darwinex offers a wide range of derivatives and the ability to trade with leverage.

Trading instruments and conditions:

- Currency pairs: 42 pairs with leverage up to 1:30 for retail clients and up to 1:200 for professional traders.

- Indices: 10 most traded world indices in CFD format. Leverage for SPA35 – up to 1:10, for others – up to 1:16.

- Commodities: Gold, platinum, oil and gas with leverage up to 1:20 for retail clients.

- ETFs and Equities: U.S. assets, including more than 100 CFDs on ETFs from Vanguard, Invesco, iShares, and more than 800 CFDs on stocks included in the Dow Jones Index and traded on the Nasdaq and NYSE.

Trading platforms:

- MetaTrader 4 and MetaTrader 5: Available for forex and CFD trading.

- Interactive Brokers: Ability to connect to more sophisticated and advanced terminals such as NinjaTrader, TWS (Trader Workstation) or TradingView.

Darwinex Useful Services:

- Blog: News and important updates about Darwinex products.

- Educational articles: Tips for beginners and recommendations on how to improve trading strategies for experienced traders.

- Money Management Programs: Both investors and experienced traders with successful strategies can participate.

- Bulletin Board: Information about exchange opening hours and changes in trading schedules.

These features make Darwinex an attractive choice for traders and investors looking for a reliable broker with a wide range of trading instruments and competitive terms.

Darwinex trading accounts overview

Darwinex provides CFD and Forex trading through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. All clients are divided into two categories: Retail traders (Retail) and Professional traders (Professional). Spreads and lot commissions are the same for all types of traders, but margin requirements differ. To trade underlying assets rather than derivatives, you must register an existing account with Interactive Brokers or open a new account through the Darwinex website.

Types of accounts:

- Retail:

- Description: ECN accounts for retail traders, designed for Forex and CFD transactions.

- Maximum leverage: 1:30.

- Trading fees: Variable spread from 0.0 pip + commission per lot.

- Professional:

- Description: Accounts for traders who meet certain requirements such as more than 10 large trades per quarter, a portfolio of 500,000 euros, or at least 1 year of financial experience.

- Benefits: Monthly discounts based on trading volume and higher leverage (up to 1:200).

- Optional: Professional clients can migrate their current MT4 accounts, Interactive Brokers accounts or accounts from other platforms.

- Darwin IBKR account:

- Description: Integration with Interactive Brokers for stock, ETF and futures trading on Trader Workstation (TWS), TradingView, NinjaTrader, MultiCharts, IB Gateway platforms.

- Trading conditions: Set by Interactive Brokers.

Darwinex also offers demo accounts on MT4 and MT5 platforms. The balance of virtual funds is selected when opening an account and a new account must be opened if the balance is exhausted. Demo accounts are blocked if not used for 20 days.

Bonuses from Darwinex

- Discounts on trading commission for professional clients:

- Conditions: To get the rebate you need to close more than 50 lots every month.

- Gradation: There is a 5-level system of discounts, calculated using a special calculator on the company’s website.

- Pricing Discounts (Pricing Discounts):

- Discount amount: 20%-40%.

- Conditions: The discount can be received by retail clients participating in the DARWIN money management program.

- D-Score algorithm: Evaluates the quality of a trader’s trading strategy and assigns a score that affects the discount percentage.

Darwinex offers traders with any experience the opportunity to choose a suitable type of account, however, the requirements for the first deposit at this broker are quite high.

Darwinex offers a variety of opportunities not only for active traders, but also for investors seeking passive income. Top traders can participate in DarwinIA’s monthly capital allocation program, where they receive up to €10 million to manage. They can also create their own DARWIN indices and receive rewards for successful asset management. Beginning investors can invest in the strategies of experienced traders using standard MetaTrader solutions such as copy-trading and trading with Expert Advisors (EA).

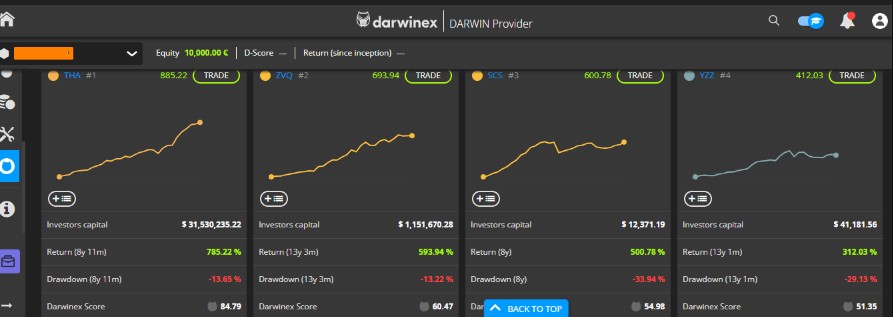

DARWIN investment platform

Experienced traders can package their strategy into a DARWIN index, while investors can invest and earn income from its management. Over 6,000 DARWIN indexes are available on the platform and can be sorted by 9 different criteria, including number of investors, productivity and date of creation.

Features of investing on the DARWIN platform:

- Management fee: 1.2% per annum on the amount of invested capital.

- Performance fee: 20% of profit (15% is received by the DARWIN index provider, 5% by the brokerage company).

- Minimum investment amount: 200 units of the wallet base currency.

- Maximum investment amount: 100,000 base currency units of the wallet.

- Minimum step of subsequent investments or partial closing: 25 units of the wallet base currency.

Algorithmic trading opportunities

Darwinex clients can earn from algorithmic trading. In addition to using EAs, solutions for professional algorithmic trading are available, such as programming trading strategies with the Zorro tool and creating custom bots and applications through the Darwinex API.

Affiliate Program Darwinex

Affiliate Program: Offer for individuals who are regulated financial advisors.

Partnership for Darwinex Zero members: Partners receive a percentage of the referral’s registration fee and each monthly subscription payment made by the referral. Additional remuneration is paid if the referral successfully manages the capital of his investors.

Darwinex does not offer referral programs for retail traders.

These features make Darwinex attractive to traders and investors seeking active or passive trading, as well as those interested in algorithmic trading and affiliate programs.

Withdrawal of funds at Darwinex

To submit a withdrawal request, Darwinex customers must go through KYC process by confirming their identity and residence.

Withdrawal Process:

- Funds transfer: Funds from the trading account are first withdrawn to the account wallet and then returned to the deposit source. Funds are not transferred to third parties.

- Time restrictions: Transfer from trading account to wallet is impossible from 21:00 to 22:00 in summer and from 22:00 to 23:00 in winter (UTC time) due to dividend settlements.

- Minimum withdrawal amount: 10 EUR/USD/GBP.

- Withdrawal fees: The amount of the fee depends on the country where the bank accepting the payment is located.

- Transfers in GBP to UK bank accounts are made without commission.

- Payments in USD are charged 15 GBP.

- For payments in EUR – 3.75 GBP.

- Withdrawal fee to SEPA countries varies from 3.75 to 15 GBP.

- Withdrawal to other countries – 15 GBP.

- Restrictions on open trades: If a trader has open trades at the time of application, only funds equal to 0.8 of the free margin of the account can be withdrawn to the wallet.

Support service

Chat on Darwinex is available 24 hours a day, 7 days a week thanks to a built-in bot. Communication is possible in Spanish, English, French and Chinese, both with the bot and with live operators.

These conditions and features make the withdrawal process at Darwinex transparent and convenient for traders, ensuring the safety and reliability of transactions.

Advantages

- Access to advanced platforms: Darwinex clients have access to advanced trading and analytics platforms from third party developers such as Trader Workstation (TWS), TradingView, NinjaTrader and MultiCharts. This enhances the ability to analyze and execute trading strategies.

- Liquidity aggregation: Darwinex aggregates liquidity from two sources with different quote generation models, ensuring competitive spreads and minimal order execution delays.

- Discounts on trading commission: Traders who demonstrate successful trading can receive discounts on trading commission. This makes trading more profitable and encourages the development of successful strategies.

- Support for algorithmic trading: Darwinex does not restrict the use of algorithmic trading. Clients can use EAs, APIs and the Zorro tool to create and automate their trading strategies.

- Combining trading and investing: Traders can combine trading and investing activities within one account. This allows for flexible capital management and various income opportunities.

Darwinex personal account overview

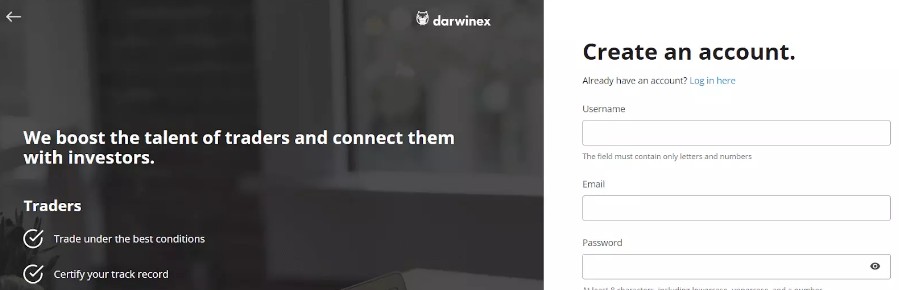

To access your personal account on the Darwinex website, you need to register. Follow the short instructions below:

- Opening an account:

- Go to the official website of Darwinex broker and click on the “Open Live Account” button.

- Filling in the registration form:

- Fill out the account opening form by providing personal data and answering questions about your trading experience, investment goals and source of income.

- Enter your e-mail address and password, which will be used for authorization in your personal cabinet.

- Access to personal account:

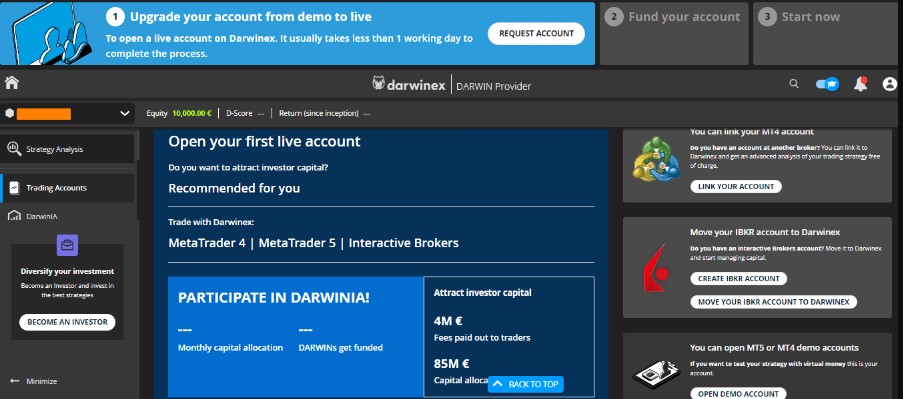

- Switching from a demo demo account to a live trading account:

- In your Darwinex personal cabinet, you can easily switch from a demo account to a live trading account.

- Selecting the DARWIN index for investment:

- Users can select the DARWIN index to invest and manage their assets.

- Switching from a demo demo account to a live trading account:

Functionality of Darwinex personal account:

- Identification:

- Uploading documents to go through the identification process.

- Financial operations:

- Deposits and withdrawals.

- Rebates and discounts:

- View information about rebates and commission discounts.

- Analyze trading strategies:

- Access to tools for analyzing trading strategies.

- Managers rating:

- Familiarization with the rating of the best managers.

- Statistics on the investment portfolio:

- Analysis and monitoring of investment portfolio indicators.

These features provide convenient account management and access to all the tools you need to successfully trade and invest on the Darwinex platform.

Answers to questions

-

How to open a real trading account with Darwinex?

-

What types of accounts does Darwinex offer?

-

What platforms does Darwinex support for trading?

-

How can I withdraw funds from my Darwinex trading account?

-

What investment opportunities does Darwinex offer?

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ