IC Markets

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountIC Markets, founded in 2007 in Sydney, Australia, is a renowned broker providing access to OTC markets worldwide. With an international network of branches located in legally diverse regions, the company offers fully legal services to traders from different countries, strictly complying with local legislation.

IC Markets has several licenses that underline its reliability and transparency in the financial market. Raw Trading Ltd is registered in Seychelles and regulated by the SFSA, International Capital Markets Pty Ltd in Australia is supervised by ASIC, and IC Markets (EU) Ltd in Cyprus is regulated by CySEC. The company is also a member of The Financial Commission, an independent organization that handles disputes between brokers and their clients and provides additional protection through an insurance fund, guaranteeing payments of up to 20,000 EUR per trader in case of disputes.

Thus, IC Markets is established as a dynamically developing broker offering its clients a safe and reliable trading platform with a global reach.

-

Account currency

USD, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD, EUR

-

Minimum deposit

200$

-

Leverage

От 1:1 до 1:500

-

Spread

From 0.6 pips - for Standard account, from 0.0 pips - for cTrader and Raw Spread accounts

-

Instruments

More than 60 currency pairs, CFDs on futures, indices, commodities, metals, more than 2100 stocks, bonds, cryptocurrencies

-

Margin call / Stop out

100% / 50%

Pros

- Favorable trading conditions: IC Markets offers competitive trading conditions that promote efficient trading in the financial markets.

- Extensive selection of trading instruments: With over 2,100 trading assets including currencies, stocks, indices, commodities and cryptocurrencies, traders can easily diversify their portfolios.

- Low spreads: Spreads start from 0 pips, which minimizes trading costs and increases potential profits.

- High speed of order execution: Fast order execution reduces risks associated with delays and provides traders with the ability to react quickly to market changes.

- Rich selection of training and analytical materials: Many resources for training and analysis help both beginners and experienced traders to improve their skills.

- Mobile Trading: Mobile trading platforms allow traders to manage their investments and trade on the go.

- Support for trading advisors: IC Markets supports the use of automated trading systems, which expands trading opportunities.

- Useful trading tools: For example, spread monitoring, market depth and risk calculator improve risk analysis and management.

- Scalping and hedging support: The broker allows the use of various trading strategies, including scalping and hedging.

- Islamic accounts: The availability of swap-free (swap-free) accounts makes IC Markets available to Shariah-compliant traders.

- Quality support service: A multilingual support team is available around the clock, providing help and solutions to any customer questions.

Minuses

- Lack of bonuses and contests: IC Markets does not offer additional incentives in the form of bonuses or trading contests, which may make the broker less attractive to traders looking for additional rewards and motivation.

- Payout delays: Sometimes traders may encounter payout delays of a couple of days. Although such delays are not frequent, they can be inconvenient for clients, especially during periods of high market volatility.

- No weekend trading: Trading through IC Markets is not available on weekends, which limits the ability of traders wishing to react to events or market changes that occur outside of the standard trading schedule.

Customer geography

-

Vietnam 11.41%

Vietnam 11.41% -

Australia 9.96%

Australia 9.96% -

United Kingdom 9.76%

United Kingdom 9.76% -

Brazil 8.99%

Brazil 8.99% -

South Africa 7.74%

South Africa 7.74% -

Thailand 6.8%

Thailand 6.8% -

Spain 6.6%

Spain 6.6% -

India 6.2%

India 6.2% -

United States 6%

United States 6% -

Singapore 5.8%

Singapore 5.8% -

Others 53.74%

Others 53.74%

Expert evaluation

IC Markets, a long-standing MOFT partner, has established its reputation as a reliable broker in the currency market. Thanks to its competitive advantages, such as low spreads, the ability to trade micro lots from 0.01, and efficient support service, IC Markets has earned recognition among traders. The broker is characterized by high speed of order execution, which is confirmed by numerous positive feedback from clients from all over the world.

During the years of cooperation with IC Markets, extensive analysis of client feedback has shown that there are no systematic complaints about the company’s work. IC Markets provides timely support in solving financial issues and promptly responds to any claims.

The IC Markets website is characterized by reliability and convenient access to the personal account. Traders can take advantage of available analytical and training materials, as well as additional resources at any time. These aspects ensure the stable popularity of IC Markets internationally, and the broker regularly occupies high positions in the MOFT Rating.

Analysis

Ribei

IC Markets clients using the Standard account type through MOFT can receive a rebate of 80% of the commission that MOFT receives from the broker. For example, if you trade 1 standard lot per day on EUR/USD, this equals 100,000 units of the base currency. With a pip cost of $10 and a broker’s spread of 0.6 pips per lot (equal to $6), MOFT receives 0.4 pips per lot ($4), of which 80% ($3.2) is returned to the trader as a rebate.

This system not only helps to reduce trading costs, but also increases your potential profits. Registering through MOFT gives you access to a number of privileges, making your trading more profitable.

Trading conditions

IC Markets caters to the needs of a wide range of clients by providing access to trading in highly liquid markets. The broker offers a variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, as well as their mobile versions, which provides traders with flexibility in choosing trading tools and strategies.

Features and capabilities of IC Markets:

- Wide range of trading instruments: Traders can choose from over 60 currency pairs, as well as a variety of CFDs on futures, indices, commodities, metals, over 2,100 stocks, bonds and cryptocurrencies. This provides opportunities to diversify your investment portfolio and participate in global trading.

- Minimal spreads and fast order execution: The company is known for its low spreads starting from 0.0 pips on Raw Spread accounts, where the average spread on the EUR/USD currency pair is only 0.02 pips. On standard accounts, the spread starts from 0.6 pips and the average value is 0.62 pips. Fast order execution minimizes slippage and improves trading results.

- Accessibility for different levels of traders: The minimum order size of 0.01 lot makes trading accessible not only for experienced traders but also for beginners, allowing them to gradually build up their trading volume.

- Affordable initial deposit: The minimum deposit is 200 USD, which makes IC Markets accessible to traders who are not ready to invest large amounts at once.

The company’s clients often mention in their reviews advantages such as competitive spreads and prompt order execution, which emphasizes IC Markets’ reputation as a reliable broker in the international arena.

-

Trading platform

МТ4, МТ5, cTrader

-

Accounts

Demo, Raw Spread, cTrader, Standard, Islamic

-

Account currency

USD, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD, EUR

-

Deposit/withdrawal

Bank cards and Wire transfer, transfer from the broker’s account, e-wallets: PayPal, Neteller, Skrill, Union Pay, BPay, POLI, Rapidpay, Klarna, Vietnamese Internet Banking

-

Minimum deposit

200$

-

Leverage

1:1 to 1:500

-

PAMM accounts

no

-

Minimum order

0.01- 200 (2000 for cTrader)

-

Spread

From 0.6 pips - for Standard account, from 0.0 pips - for cTrader and Raw Spread accounts

-

Instruments

More than 60 currency pairs, CFDs on futures, indices, commodities, metals, more than 2100 stocks, bonds, cryptocurrencies

-

Margin call / Stop out

100% / 50%

-

Liquidity provider

NAB, Westpac

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Execution Order

-

Trading features

Automatic trading is allowed

-

Contests and bonuses

When trading over 15 lots - free VPS

Commissions

Our analysts have performed a detailed review of IC Markets for trading and non-trading commissions. The following aspects were considered as part of the analysis:

- Trading Commissions: IC Markets has set commissions of $6 and $7 for cTrader and Raw Spread ECN accounts respectively. These commissions are applied per trade. Standard accounts do not charge trading commissions, which can be attractive to traders who prefer to trade without additional fees.

- Non-trading fees : IC Markets does not charge additional withdrawal fees on most payment methods, which is a significant advantage for traders. However, a fee of approximately 20 Australian dollars (AUD) is charged when using international wire transfers. This is standard practice for many brokers, but is important to consider when planning financial transactions.

Thus, IC Markets offers competitive commission terms, especially considering the absence of additional fees for withdrawals via most payment methods. This makes the broker an attractive choice for active traders, especially those looking for efficient conditions for working on ECN accounts.

Broker Overview

IC Markets, existing for more than 10 years, has established itself as one of the most reliable platforms for Forex trading. The company strives to provide its clients with the best conditions by continuously improving trading tools and platforms, as well as the level of service.

Regulators and Insurance: IC Markets is regulated by organizations such as CySEC in Cyprus, ASIC in Australia and SFSA in Seychelles. In addition, the company is insured through H Savy Insurance Co Ltd, which further increases the level of protection for traders’ finances.

Platforms and tools: Traders can choose between MT4, MT5 and cTrader platforms, as well as mobile versions for trading flexibility. IC Markets offers more than 60 currency pairs, as well as a wide range of CFDs including futures, indices, commodities, metals, stocks, bonds and cryptocurrencies. The minimum deposit is $200, making the platform accessible to a wide range of investors.

Speed and reliability: The company’s trading servers are located in data centers NY4 in New York and LD5 in London, equipped with high-quality hardware. Communication with price providers via fiber optic lines minimizes delays and speeds up order execution, which is especially important for scalpers and traders using algorithmic trading.

Mobile trading and additional services: IC Markets mobile application provides traders with the ability to trade and manage their portfolio from any location. In addition, traders can take advantage of services such as auto-trading via Myfxbook and VPS servers for round-the-clock trading.

Account Options: IC Markets offers several types of accounts:

- Raw Spread (cTrader): Commission 6 USD per lot, spread from 0.0 pips, cTrader platform is used.

- Raw Spread (MetaTrader): Spread from 0.0 pips, commission 7 USD per lot, available on MetaTrader 4 and 5 platforms.

- Standard: No commission, spread from 0.6 pips, available on MetaTrader 4 and 5 platforms.

Customer Support: IC Markets customer support is available 24 hours a day, 7 days a week, providing help and support to traders with any questions they may have.

These factors make IC Markets the preferred choice for both active and passive investors looking for a reliable broker with a wide range of instruments and a high level of service.

Advantages

- Low spread: Thanks to cooperation with leading price providers, IC Markets offers traders a low spread starting from 0 pips, which significantly reduces trading costs.

- Fast order execution: Minimal latency and high speed of order execution are ensured due to the location of servers in major financial centers such as New York and London.

- Application of advanced technology: IC Markets invests in high technology to provide traders with quality and reliable tools for efficient trading.

- Optimal trading conditions: The broker creates conditions that make trading more comfortable and less stressful for clients.

- Direct access to market prices: Order processing technology routes trades directly to liquidity providers, allowing traders to get the best prices based on transaction volume.

- One-click trading and additional tools: Convenient features such as one-click trading, asset correlation calculator, market sentiment indicator and tools to hide orders from other users speed up and simplify trading decisions.

- Islamic accounts: The availability of non-interest bearing accounts allows Shariah compliant customers to participate in trading without violating religious principles.

- Flexibility in trading strategies: IC Markets does not limit its clients in their choice of trading strategies. Scalping, hedging and algorithmic trading are allowed and supported on all account types.

IC Markets Personal Account Overview

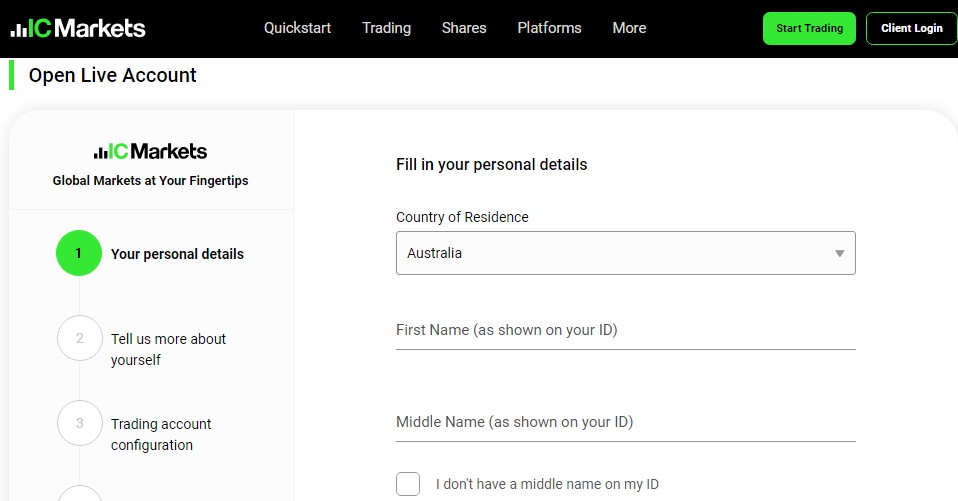

Follow these simple steps to get started with IC Markets:

1. Log in to your personal account:

- Go to the main page of the IC Markets website.

- Click on the “Client Login” button to log in to your account. If you are not already registered, select the “Open an account” option.

2. Authorization and Registration:

- To log in, enter your e-mail address and password.

- New users will need to complete the registration form, entering actual personal data for further verification. Make sure the information provided is accurate to avoid problems with account activation.

Functions of the personal account:

- In your personal cabinet you will be able to open a trading account and replenish it.

- In the account settings section you can change your current settings.

- You can also apply for withdrawal of funds.

IC Markets’ personal account provides convenient access to all the tools you need to manage your trading and financial transactions, ensuring a smooth interaction with the platform.

Answers to questions

-

What documents are required to verify an account with IC Markets?

-

What fees does IC Markets charge for trading

-

Is it possible to trade cryptocurrencies on IC Markets

-

What deposit and withdrawal methods are available at IC Markets

-

What trading platforms are available at IC Markets

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ