XM Group

Collected complete information about all forex brokers, explore all their advantages and start earning mone

Открыть счетXM Group, founded in 2009, is an international broker with several companies within its structure, each of which is licensed by various regulators including CySEC (Cyprus), FSC (Belize), DFSA (UAE), and ASIC (Australia). This structure allows XM Group to operate globally while complying with local legislation, making it accessible to traders around the world.

Initially specializing only in intermediary services in the foreign exchange market, XM Group has expanded its services over time and now offers universal brokerage services in almost all countries of the world. The company has grown significantly in recent years, attracting more than 5 million traders through innovative technological solutions and improved service quality.

XM Group regularly receives industry awards, including such nominations as “Fastest Growing Broker” and “Best Forex Service Provider”, which confirms its reputation in the financial world. The team is constantly striving for excellence, never resting on its laurels and improving the quality of its services every year.

-

Account currency

USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR (may vary depending on account type)

-

Minimum deposit

Micro, Standard - 5 USD. XM Ultra Low - USD 5, XM Ultra Low - USD 5, Shares - USD 10 thousand. XM Ultra Low - 5 USD, Shares - 10 thousand USD. USD

-

Leverage

Up to 1:1000(depending on the trading instrument)

-

Spread

Micro, Standard - from 1 point, XM Ultra Low - from 0.6 point, Shares - exchange spread, according to the terms of individual exchanges

-

Instruments

Currency pairs, commodities, stock indices, precious metals, energy, cryptocurrencies, stocks, CFDs on stocks

-

Margin call / Stop out

50%/20%

Pros

- High level of order execution: XM Group guarantees 100% order execution, with 99.35% of orders executed in less than 1 second. The company also provides requote-free trading, which is a significant advantage in fast-changing market conditions.

- Competitive spreads without markups: The broker offers narrow market spreads without additional markups, allowing traders to reduce trading costs and increase potential profits.

- Wide range of trading instruments: With over 1,000 trading instruments available, including over 55 currency pairs, various metals (palladium and platinum), commodities (cocoa, cotton, grains) and equities, XM Group offers one of the broadest asset selections in the market.

- No commissions for financial transactions: the Company does not charge commissions for deposit and withdrawal of funds, covering all possible commissions of payment systems, which makes financial transactions more favorable for clients.

- Multilingual customer support: 24/7 customer support is available 5 days a week in more than 30 languages, providing quality service to traders around the world.

Minuses

- Lack of passive investment platforms: XM Group does not offer social trading services or PAMM accounts, which allow clients to invest in trading by copying trades of successful traders or managing funds through professional money managers. This can be a significant drawback for those looking for passive investment opportunities.

- Limited choice of trading platforms: Although XM Group offers 16 different versions of trading terminals, they are all modifications of the MetaTrader 4 and MetaTrader 5 platforms, adapted for desktop, browser and mobile interfaces. The lack of a wider selection of specialized or alternative trading platforms may limit traders who prefer variety in trading tools and more flexible trading systems.

Customer geography

-

Thailand 43.99%

Thailand 43.99% -

South Africa 17.29%

South Africa 17.29% -

Colombia 7.14%

Colombia 7.14% -

Philippines 6.87%

Philippines 6.87% -

Vietnam 6.52%

Vietnam 6.52% -

Singapore 5.82%

Singapore 5.82% -

Malaysia 5.33%

Malaysia 5.33% -

Mexico 5.26%

Mexico 5.26% -

Brazil 4.66%

Brazil 4.66% -

Namibia 4.12%

Namibia 4.12% -

Others 26%

Others 26%

Expert evaluation

XM Group presents favorable opportunities for professional trading, thanks to its high-speed order processing and competitive commissions. The company’s main advantage is its licenses from four leading global regulators: ASIC in Australia (ACN:164 367 113), FSC in Belize (000261/397), CySEC in Cyprus (120/10) and DFSA in UAE (F003484), which underlines its reliability and commitment to high standards.

Regarding account types, XM Group ensures uniform order execution quality across all accounts, which includes minimal requotes and no slippage. Clients can use a maximum leverage of up to 1:1000, although this may vary depending on the financial instrument chosen.

For newcomers to trading, XM Group offers particularly attractive conditions: the minimum deposit is only 5 USD, and cent accounts with a lot of 1000 units are available, which allows you to start trading with low risk.

Analysis

Trading conditions

XM Group’s trading conditions are ideal for both beginners and experienced traders. The company offers a variety of accounts, including Cent, Standard and Shares Accounts, which provides flexibility in choosing the best conditions for each user. The minimum deposit is set at an affordable level, and the leverage offered is relatively high, which expands trading opportunities.

A demo account is available for new users, which allows them to familiarize themselves with the functionality of trading platforms and practice strategies without the risk of losing real funds. XM Group provides more than 1000 trading instruments and the possibility to open up to 8 active trading accounts for each client, as well as protection against negative balance on all types of accounts.

On the MT5 platform, trading of various assets is available, while MT4 restricts users by not allowing trading CFDs on stocks. Spreads on Standard and Micro accounts start at 1 pip, while XM Ultra Low starts at 0.6 pips and there is no lot commission. The Shares account is characterized by market spread and turnover fee, as well as a ban on hedging positions.

XM Group does not charge commissions for deposit and withdrawal of funds, offering a wide range of payment systems and instant deposit. The company also actively maintains a bonus program and holds seasonal promotions. Participation in the loyalty program allows clients to receive rewards that can be used for trading, thus increasing their trading capital.

-

Trading platform

MT4, MT5 (16 platform modifications)

-

Accounts

Micro, Standard, XM Ultra Low, Shares

-

Account currency

USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR (may vary depending on account type)

-

Deposit/withdrawal

Neteller, Skrill, Perfect Money, Wire Transfer, Visa/Mastercard, Neteller, Skrill, Perfect Money, Webmoney, StickPay.

-

Minimum deposit

Micro, Standard - 5 USD. XM Ultra Low - USD 5, XM Ultra Low - USD 5, Shares - USD 10 thousand. XM Ultra Low - 5 USD, Shares - 10 thousand USD. USD

-

Leverage

Up to 1:1000(depending on the trading instrument)

-

PAMM accounts

no

-

Minimum order

From 0.01 lot (from 1 lot for Shares account)

-

Spread

Micro, Standard - from 1 point, XM Ultra Low - from 0.6 point, Shares - exchange spread, according to the terms of individual exchanges

-

Instruments

Currency pairs, commodities, stock indices, precious metals, energy, cryptocurrencies, stocks, CFDs on stocks

-

Margin call / Stop out

50%/20%

-

Liquidity provider

no data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Execution, Instant Execution

-

Trading features

There are Islamic accounts, there is an opportunity to connect to the MQL5 trading signals service

-

Contests and bonuses

yes

Commissions

Analysts conducted a thorough review of trading and additional account fees at XM Group and reached the following conclusions:

- No additional commissions: Most XM Group accounts have no additional commissions, which makes them attractive for traders seeking to minimize their expenses.

- Commissions on Shares account : The only exception is the Shares account, where traders are required to pay an exchange commission based on a fixed volume of trades. This is a standard practice for stock trading through brokerage platforms.

- No Hidden Commissions : An important feature of XM Group is complete transparency on commissions, which ensures that there are no unforeseen costs for clients.

- No deposit and withdrawal fees: XM Group does not charge any deposit or withdrawal fees, which simplifies financial transactions and makes them more profitable for traders.

- Floating Swap Fee : The only fee that may vary depending on the market situation is the fee for carrying trades to the next trading day (swap). This fee changes according to current market conditions, which requires traders’ attention when planning long-term positions.

Thus, XM Group offers competitive and transparent conditions, which can be beneficial for both beginners and experienced traders, especially those who appreciate honesty and openness in financial matters.

Broker Overview

XM Group provides a wide range of services for traders of all levels and is one of the leading brokers in the European market. Here is a brief overview of the key aspects of trading with XM Group to help you get started:

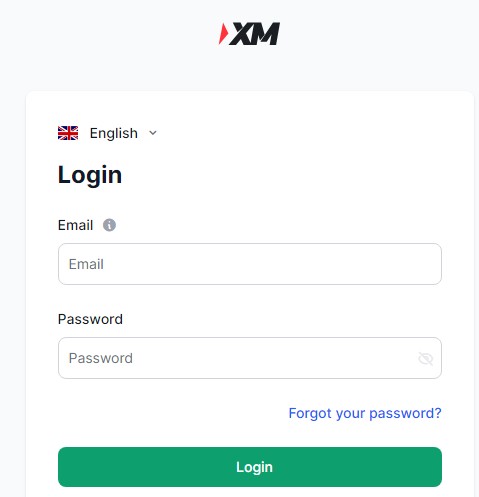

Log in to my personal cabinet

- Access: Through the home page of the site, click on “My Account”.

- Authorization: Enter your email or personal account number and password. Quick authorization via Google, Facebook or WebMoney is available.

Registration

- Process: On the login page, select “Open an account”. Enter your name, phone number, email and password, and pass passport verification.

- Alternatives: Quick registration via Google, Facebook or WebMoney.

Main features of the personal cabinet

- Trading Instruments: Choose from more than 1000 instruments.

- Analytics and News: Constantly updated market information.

- Training: Access to training materials and demo account.

- Quotes: Real-time monitoring of current prices.

- Support: Get help in more than 30 languages.

Types of trading accounts

- Micro: Minimum deposit $5, lot of 1000 units.

- Standard: Standard lot of 100,000 units, minimum deposit of $5.

- XM Ultra Low: Spread from 0.6 pips, deposit from $5, access to hedging.

- Shares: Specialized account for trading shares with market spread and commission.

Useful tools

- All-in-One Calculator: Calculation of margin, swap, pip value.

- Stop Loss and Take Profit Calculator: Help in setting pending orders.

- Technical indicators: Toolkit for MT4 and MT5.

Bonuses and promotions

- Welcome bonus: 100% on the first deposit up to $5000.

- Seasonal promotions: Participation in drawings and lotteries with cash prizes.

Withdrawal of funds

- Methods: Visa/Mastercard, Neteller, Skrill, and others.

- Processing Time: Usually within 24 hours.

- Fees: No deposit or withdrawal fees, except for possible bank charges for transactions over $200.

XM Group emphasizes active trading, offering advanced technologies and a comprehensive set of tools for successful trading in the global financial markets.

Advantages

- Multi-level regulation: XM Group has licenses from four reputable regulators, including CySEC (Cyprus), which allows the broker to operate legally in many countries around the world, complying with local legislation.

- Reliable trading platforms: The Company offers time-tested and well-known MetaTrader 4 and MetaTrader 5 platforms in various modifications that meet the needs of both beginners and professional traders.

- Variety of trading accounts: XM Group offers a variety of accounts - from micro-accounts for beginners, providing the opportunity to trade with less risk, to standard accounts and specialized Shares Accounts for experienced traders.

- Free market analysis: XM Group clients have access to in-depth and up-to-date Forex market analysis to help them make informed trading decisions.

- Educational Resources: Daily webinars and free trading signals provide traders with the knowledge and support they need to improve their trading strategies.

- Negative Balance Protection: This benefit ensures that traders do not lose more than they have in their trading account, which is an important feature for risk management.

XM Group personal account overview

To get started with XM Group, you can open either a live or demo account directly from the broker’s homepage. A demo account is provided with an initial virtual amount of 100,000 USD, allowing you to familiarize yourself with the platform without the risk of losing real funds. However, in order to fully access the personal account and start trading, you need to register a real account.

Registration of a real account at XM Group

- Registration: Fill out the registration form on the website, indicating your first name, last name, country of residence, phone number and e-mail address. Select the desired platform and account type. All data should be entered in Latin characters.

- Login and platform: After registration, an account number will be sent to your e-mail address, which will be used as a login. Download the trading platform from the broker’s website and link your account to it to start trading.

- Login: Once you have received your login details, you will be able to log in to your personal account. Please note that initial registration will take about 10 minutes and will only allow you to familiarize yourself with the functionality of the cabinet. To start trading, it is necessary to undergo the verification procedure.

Functions of XM Group personal account

The following options are available in your personal account:

- Deposit and Withdrawal: Manage your finances directly from your personal cabinet.

- Adjust personal account data: Change leverage, view transaction and trade history, including current open positions.

Additional features include:

- Changing the password and setting up two-step authentication.

- Request to use VPS server available after verification.

- Access to trading signals and support service.

- Participation in the “Invite a Friend” affiliate program.

These tools and resources provide convenient and efficient management of your trading operations and help improve your trading experience at XM Group.

Answers to questions

-

How can I register a trading account with XM Group

-

What types of accounts are available with XM Group

-

What commissions does XM Group charge

-

What deposit and withdrawal methods are available at XM Group

-

Does XM Group offer educational resources and support

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ