OctaFX

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountOctaFX, operating since 2011, is an established broker licensed by CySEC (372/18) and offers favorable conditions for forex trading. With more than 6.6 million customers worldwide, the company is particularly popular in the Asia-Pacific region. OctaFX caters to both active traders and passive investors who prefer to use the copy trades feature. In 2020, the company was named the best CFD broker in the Asia-Pacific region by Capital Finance International, and in 2021 it was awarded as the best Forex broker in Asia by Global Banking and Finance Review.

-

Account currency

USD, EUR

-

Minimum deposit

From $25. USD

-

Leverage

Up to 1: 500

-

Spread

From 0.6 points

-

Instruments

32 currency pairs, 5 cryptocurrencies, CFDs on energy resources, indices, gold and silver

-

Margin call / Stop out

25% / 15%

Pros

- Reliable trading platforms: OctaFX provides access to popular and proven trading platforms MetaTrader 4 and MetaTrader 5, which guarantees stability and wide trading opportunities.

- Competitive trading conditions: The company offers narrow spreads starting from 0.6 pips and does not charge commissions for deposit and withdrawal, which makes trading more cost-effective.

- Wide range of trading instruments: Traders have access to a variety of assets and can use the service of copying trades, which expands their trading strategies and opportunities.

- Accessibility for beginners: The minimum deposit to start trading is only $25, making the platform accessible to a wide range of investors.

- Licensing and regulation: OctaFX has a license from the Cypriot regulator CySEC, confirming its reliability and compliance with international standards.

- High quality of order execution: More than 97% of orders are executed without slippage, which indicates high quality and speed of trading operations processing.

- Flexible trading conditions on MT4: On the MetaTrader 4 platform, traders can choose between floating and fixed spread types, allowing them to optimize trading strategies according to personal preferences and market conditions.

Minuses

- Limited choice of investment solutions for passive income: OctaFX offers limited options for those seeking passive income through investment programs. This can be a significant disadvantage for investors who prefer less active participation in trading.

- Variable list of payment systems and non-transparent commissions: The company's clients face changes in the list of available payment systems, which may cause inconvenience. In addition, the absence of clearly specified amounts of commissions for using different electronic payment systems (EPS) on the OctaFX website reduces the transparency of financial transactions.

Customer geography

-

Indonesia 99.2%

Indonesia 99.2% -

India 4.1%

India 4.1% -

Malaysia 2.5%

Malaysia 2.5% -

Others 2.2%

Others 2.2%

Expert evaluation

OctaFX, an international broker, emphasizes on providing competitive conditions for Forex traders of all levels. With minimum spreads starting from 0.6 pips and no deposit and withdrawal fees, OctaFX supports a wide range of trading strategies. Additionally, the broker incentivizes client participation through bonuses and demo contests where winners can receive real cash prizes.

OctaFX offers popular trading platforms MetaTrader 4 and MetaTrader 5, which are available for use on various devices, including mobile. Despite the lack of cent accounts, the broker provides an opportunity to test strategies on demo accounts available on all trading platforms, which can compensate for this disadvantage.

The OctaFX website contains extensive resources including tutorials, analytics and forex news, making it a useful resource for beginners and experienced traders alike. The broker’s support team responds quickly, providing answers to customer queries within minutes.

This provides a clearer picture of what OctaFX offers and helps potential clients better understand what to expect from working with this broker.

Analysis

Ribeit

For more than ten years, the International Organization of Forex Traders (IOFT) has been paying spread rebates to Forex traders. The organization reimburses up to 100% of the commissions withheld by the broker for each trade made, regardless of whether it is closed with a profit or loss. To participate in the rebate program, you simply need to register on the MOFT website, which is a quick and free process, and open an account with one of MOFT’s partner brokers. On the MOFT website you will find detailed instructions on how to become a partner and start receiving rebates.

Try the program – you will appreciate its advantages!

Trading conditions

OctaFX trading conditions are designed to meet the needs of both experienced and novice Forex traders. The broker offers competitive narrow spreads starting from just 0.6 pips and provides access to a wide range of trading assets. Traders can take advantage of popular trading platforms for efficient operation.

The maximum leverage varies depending on the type of asset: for currencies it can reach 1:500, for cryptocurrencies – 1:10, for metals – 1:200, for oil – 1:100 and for indices – 1:50. This allows traders to choose the optimal leverage according to their trading strategy and risk appetite.

The minimum deposit for all account types is $25, which makes access to trading on OctaFX more affordable for a wide range of investors. The broker also stimulates clients’ activity by offering bonuses for account funding and organizing regular contests with valuable prizes, including cash and trading rewards.

Thus, OctaFX provides flexible and favorable conditions for all categories of traders, contributing to their trading success in the global financial markets.

-

Trading platform

MetaTrader 4, MetaTrader 5, OctaTrader

-

Accounts

Demo, OctaFX MT4, OctaFX MT5

-

Account currency

USD, EUR

-

Deposit/withdrawal

Bank transfer, Neteller, Skrill, Visa cards, Bitcoin, Cryptocurrency

-

Minimum deposit

From $25. USD

-

Leverage

Up to 1: 500

-

PAMM accounts

no

-

Minimum order

0,01

-

Spread

From 0.6 points

-

Instruments

32 currency pairs, 5 cryptocurrencies, CFDs on energy resources, indices, gold and silver

-

Margin call / Stop out

25% / 15%

-

Liquidity provider

No data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Execution

-

Trading features

Any trading strategies are allowed, you can open an MT4 account with floating or fixed spreads

-

Contests and bonuses

Contests on MT4 demo accounts, Status Program

Commissions

Analysts of the International Organization of Forex Traders (IOFT) conduct a thorough analysis of trading conditions of various brokers to assess the impact of commissions on trading performance. Their study of OctaFX trading conditions revealed that the broker charges trading commissions in the form of spread on all types of accounts, which is a standard practice in the market.

OctaFX does not deduct commission from clients for deposit and withdrawal of funds, which is a significant advantage for traders. However, it should be noted that individual payment systems may apply their own transaction fees, which clients are advised to find out in advance from their financial institutions or electronic payment systems.

For users of the MetaTrader 5 (MT5) platform, OctaFX offers swap-free accounts, which can be particularly attractive for traders using long-term trading strategies. Also, traders using MetaTrader 4 (MT4) can choose to open an Islamic account, which is exempt from swaps and other types of Sharia-compliant fees.

These conditions underline OctaFX’s transparency and flexibility in providing services to its clients, allowing traders to optimize their trading strategies and minimize costs associated with commissions.

Broker Overview

OctaFX has been providing brokerage services in the global financial market for over a decade, during which time it has significantly expanded its client base. The company cooperates with many liquidity providers around the world, which allows its clients to enjoy competitive aggregated prices. OctaFX servers and data centers located in Europe and Asia provide low latency and reliable connections. Thanks to the ECN/STP model, the company executes orders in less than 0.1 seconds.

The following statistics have been published on the official OctaFX website:

- More than 6.6 million open trading accounts.

- Over 500 million trades executed.

- Serving clients from more than 100 countries.

- 38 international awards from recognized financial institutions.

OctaFX acts as a reliable Forex broker, offering its clients favorable conditions: low spreads, various methods of deposit and withdrawal without commission, protection against negative balance. Clients have access to a variety of trading instruments, including cryptocurrencies such as Bitcoin, Ethereum and others, as well as traditional currencies, metals and CFDs. MetaTrader 4 and MetaTrader 5 platforms are available in mobile and desktop versions, as well as via web browser.

OctaFX provides the following useful services:

- Autochartist: an automatic notification service for MT4 and MT5 that predicts trends with over 83% accuracy.

- Traders tools: a set of tools for traders, including profit calculators, real-time quotes and the ability to copy the best accounts.

- Analytics: a section with market information, economic calendar, analytics and Forex news.

OctaFX allows the use of all types of trading strategies, including hedging, scalping, trading on news and the use of trading advisors.

Advantages

- High leverage: Trading on OctaFX allows for a maximum leverage of 1:500 for currency pairs, which increases the potential returns when managing risk.

- Strict security: OctaFX protects clients' financial and personal data with SSL encryption, backed by licensed and segregated accounts, ensuring a high degree of protection of funds.

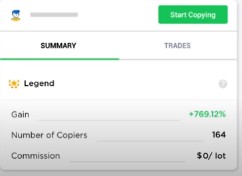

- Trade Copying Platform: Clients can automatically copy trades of experienced traders, which allows passive participation in trading with the possibility of risk control.

- Extensive analytical resources: Users have access to in-depth market analysis, up-to-date Forex news and real-time quotes to facilitate informed trading decisions.

- Efficient support via online chat: OctaFX support service quickly responds to clients' requests, providing assistance on technical issues and promptly solving users' problems.

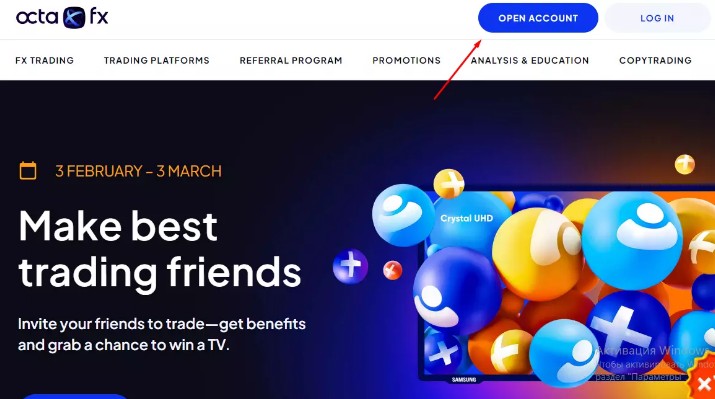

OctaFX Personal Account Overview

To start trading with OctaFX, follow the steps below to open a trading account and set up your Personal Cabinet:

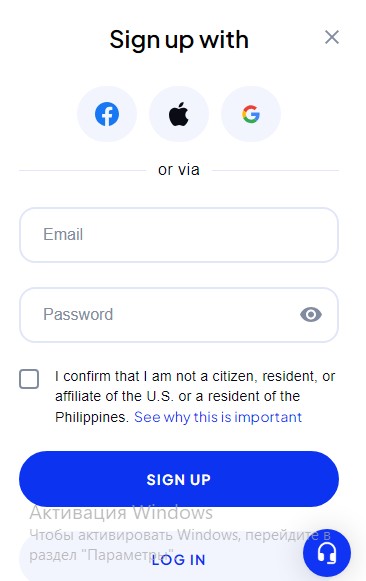

- Account registration:

- Go to the OctaFX homepage and click on the “OPEN ACCOUNT” button.

- Fill in the registration form with your first name, last name and e-mail address, or use quick registration via Facebook or Google.

- Confirm your e-mail address and log in to your Personal Cabinet.

- Setting up a trading account:

- In myAlpari, select the desired account type from the available options (MT4, MT5, cTrader) and continue the process.

- After selecting an account, an email will be sent to your email with your credentials and PIN code to access the account.

- Verification and trading:

- Go through the identity verification procedure to activate the full functionality of the account.

- Make a deposit and start trading by selecting the financial instruments you need.

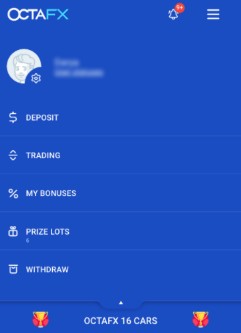

OctaFX Personal Cabinet features include:

- Deposit and Withdrawal: Easy access to financial transactions and activation of deposit bonuses.

- Copy trades: Connect to the platform to copy strategies of successful traders.

- Trading via web terminal: Access to the web platform to trade on a PC or mobile device.

- Customize trading conditions: Ability to change leverage and switch between standard and Islamic accounts.

- Participate in Monitoring: Share your trading results and follow the activity of other traders, choosing whom to copy.

These steps will help you to effectively start trading with OctaFX and utilize all the opportunities provided by the broker.

Answers to questions

-

What documents do I need to verify my OctaFX account

-

What trading platforms does OctaFX offer

-

What deposit methods are available in OctaFX

-

How can I participate in contests on OctaFX demo accounts

-

How does OctaFX protect clients' funds and data

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ