AMarkets

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountAMarkets brokerage company, founded in 2007 under the name AForex, underwent significant changes and became well-known in Europe and the CIS. Over time, the company was renamed and grew to the status of a reliable ECN broker meeting European service standards. AMarkets today offers a wide range of services aimed at both newcomers to the world of trading and algorithmic trading professionals, emphasizing its commitment to innovation and quality customer service.

-

Account currency

EUR, USD, RUB, ВТС

-

Minimum deposit

Fixed, Standard - $100 / €100 / ₽7000, ECN - $200 / €200 / ₽14000

-

Leverage

Up to 1:3000

-

Spread

ECN - floating from 0 pips, Standard - floating from 1.3 pips, Fixed - fixed from 3 pips, Crypto - floating from 1.3 pips.

-

Instruments

Currencies, stock and commodity market assets, cryptocurrencies

-

Margin call / Stop out

50–100% / 20–40%

Pros

- High speed of order execution - from 35 to 50 ms, which is much faster than the market average (200-500 ms).

- Competitive market spreads - starting at 0.3 points, while the market average is 0.5 points.

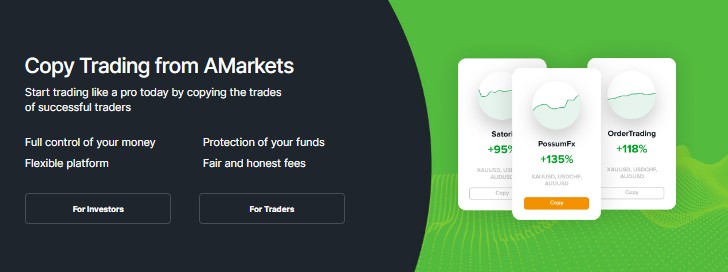

- A copy-trading service that allows clients to copy the strategies of successful traders.

- Integrated analytical tools in myAlpari, including signals, risk management tools and support for algorithmic trading.

- A compensation fund per client, guaranteeing compensation of up to €20,000, which reinforces the confidence and security of the investment.

Minuses

- Trading Expert Advisors with basic settings often turn out to be unprofitable. Using standard templates without prior detailed testing can lead to losses.

- Lack of regulatory license. Although AMarkets is registered in St. Vincent and the Grenadines, the company does not have a license from a recognizable financial regulator, which may raise questions about the legal security and reliability of the broker. The Financial Commission, mentioned by the company, is not a licensing body.

Customer geography

-

Russia 13.3%

Russia 13.3% -

Ukraine 8.8%

Ukraine 8.8% -

Uzbekistan 6.1%

Uzbekistan 6.1% -

Indonesia 4.3%

Indonesia 4.3% -

Turkey 3.2%

Turkey 3.2% -

Malaysia 2.4%

Malaysia 2.4% -

Belarus 1.8%

Belarus 1.8% -

Kazakhstan 1.4%

Kazakhstan 1.4% -

Nigeria 1.1%

Nigeria 1.1% -

South Africa 0.4%

South Africa 0.4% -

Others 28.2%

Others 28.2%

Expert evaluation

AMarkets brokerage company stands out from other market participants by its focus on efficiency and comfort in trading. Specializing in STP accounts, AMarkets offers competitive conditions with fast order execution speed of up to 0.1 seconds and narrow spreads starting from 1.3 pips. These indicators, combined with direct order entry to liquidity providers, make AMarkets an attractive choice for experienced traders seeking to maximize the effectiveness of their trading strategies.

The minimum deposit of $100 positions AMarkets as a platform for serious traders, excluding casual market participants. The broker provides extensive analytical resources, including signal services and algorithmic robots, making it especially valuable for those looking to enrich their trading skills. In addition, a free VPS server is available for demanding clients, which reinforces AMarkets’ appeal to professionals.

It is important to note that the company is registered in the jurisdiction of Saint Vincent and the Grenadines, which requires additional consideration in terms of regulatory protection and licensing. Such information should be taken into account when choosing a broker.

Analysis

Ribeit

The REBATE affiliate program from AMarkets broker is an effective tool for stimulating trading activity and increasing client loyalty. The rebate system allows partners to return to their clients a part of the paid spread on each concluded transaction, which makes trading more profitable.

This approach provides clients with additional income regardless of the outcome of trading operations. The return of part of the spread directly increases their trading activity, which, in turn, contributes to the growth of partner remuneration. This model of work motivates traders not only to increase trading volumes, but also to attract new clients interested in optimizing their trading conditions.

The REBATE program is an excellent choice for AMarkets partners seeking to provide the most attractive and competitive conditions for their clients, thereby increasing their efficiency and strengthening their market presence.

Trading condition

AMarkets trading conditions are ideal for those who are looking for a long-term and fruitful cooperation with the broker. The broker offers a minimum deposit starting from USD 100 and provides the opportunity to use leverage up to 1:3000, while for cryptocurrency trading the leverage is limited to 1:100.

AMarkets operates based on STP and ECN models, guaranteeing order execution in 100 milliseconds on average, which is 30-50 milliseconds on average. This ensures that traders can trade efficiently. The broker allows trading during the news period, telephone dealing and offers protection against negative balance. The use of automated trading systems and robots is allowed, and copy-trading service is available for those wishing to receive passive income.

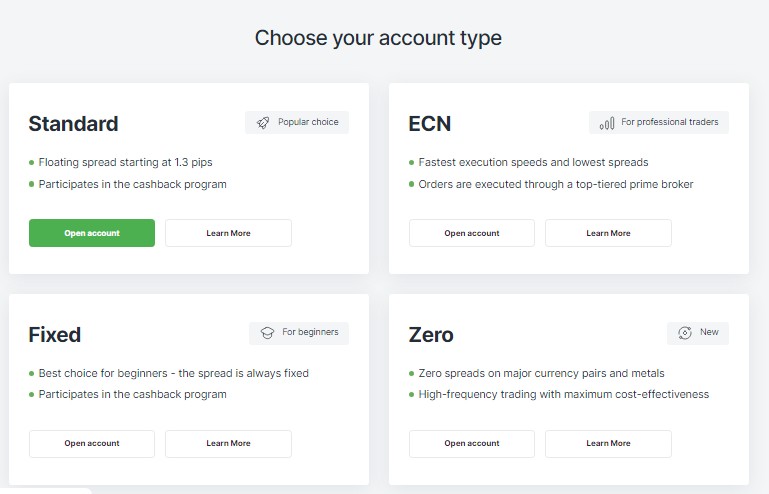

Accounts variability includes both floating spreads starting from 0.0 pips and fixed spreads from 3 pips. ECN accounts are subject to a commission of 2.5 dollars per lot on each side of the transaction, while for standard and fixed accounts there is no commission. The broker supports trading via MT4 and MT5 platforms, AMarkets App and MultiTerminal for managing multiple accounts simultaneously.

AMarkets stands out for its variety of bonus programs, including cashback and switching bonuses from other brokers. Rewards for success on demo accounts are also offered, as well as regular promotions and drawings.

-

Trading platform

MT4, MT5 (all modifications), AMarkets App

-

Accounts

Standard, Fixed, ECN, Crypto

-

Account currency

EUR, USD, RUB, ВТС

-

Deposit/withdrawal

Visa/Mastercard, Bank Transfer, МИР, UZCard, HUMO, Perfect Money, Neteller, FasaPay, Bitcoin. Ethereum, Litecoin, Tether (USDT TRC20, ERC20). AdvCash, Skrill, QIWI (for selected regions)

-

Minimum deposit

Fixed, Standard - $100 / €100 / ₽7000, ECN - $200 / €200 / ₽14000

-

Leverage

Up to 1:3000

-

PAMM accounts

no

-

Minimum order

0,01

-

Spread

ECN - floating from 0 pips, Standard - floating from 1.3 pips, Fixed - fixed from 3 pips, Crypto - floating from 1.3 pips.

-

Instruments

Currencies, stock and commodity market assets, cryptocurrencies

-

Margin call / Stop out

50–100% / 20–40%

-

Liquidity provider

no data

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Instant Execution, Market Execution (depending on the account)

-

Trading features

cryptocurrency trading

-

Contests and bonuses

yes

Commission

Analysts analyzed the offer and trading conditions of AMarkets and confirmed the absence of hidden commissions. It is noted that there is no deposit fee, but withdrawals are subject to fees, the amount of which depends on the chosen method and payment system. On average, the withdrawal fee ranges from 0.5% to 1.8% and is the same for all types of accounts.

Additional commissions include swaps: single swap for transferring trades to the next trading day and triple swap for transferring trades through the weekend. ECN accounts are also subject to a fixed commission of USD 2.5 for each side of the transaction, which amounts to USD 5 for a full standard lot.

Broker Overview

Since 2007, AMarkets brokerage company has been providing clients with access to international financial markets. The company is interested in the success of its clients and tries its best to create the most comfortable conditions for trading. Today, AMarkets is a company that is among the top five European brokers in terms of the number of successful clients. That is why the broker offers beginners a comprehensive free trading course, daily webinars with professional traders, and attractive bonuses for a quick start.

Brief information about AMarkets broker:

- The company’s capital is €100 million (Tier 1).

- The broker serves retail and institutional clients in more than 170 countries.

- Received more than 18 international awards.

- Offers four trading platforms.

- Participates in seven international sponsorships.

- Trades in six asset classes.

- Order execution speed is less than 11.06 ms.

- More than 7000 client orders are executed per second.

AMarkets is the perfect choice for investing:

AMarkets is constantly engaged in research and development to ensure that the services meet the highest customer requirements. Its ultra-fast execution speed makes it the preferred broker for algorithmic trading. Traders can count on educational materials and multilingual support regardless of their experience.

Constant analysis of clients’ needs and implementation of the latest technologies have allowed the broker to remain among the best brokerage companies in the industry for more than fifteen years. Every year AMarkets confirms its reputation as one of the most stable and reliable financial companies in the world.

Additional AMarkets services:

- VPS hosting: provides uninterrupted trading even in case of internet or power outages, popular among algorithmic traders.

- Educational programs: offered from basic courses for beginners to advanced modules for experienced traders.

- FxPro App: a mobile application with advanced charting tools and integrated account management.

- FxPro Tools: an essential trading application providing real-time analytics, currency pairs, indices and metals quotes.

- FxPro Direct: a new way to manage your trading account, offering up-to-date market information and seamless FxPro Wallet management right from your smartphone.

How to start earning – a guide for traders:

AMarkets offers several trading platforms including MT4/MT5, cTrader and the browser-based FxPro Trading Platform, each suitable for different account types:

- MT4 Standard: $100 USD minimum deposit required, spreads from 1.2 pips.

- MT4 Pro: $1,000 USD deposit required, tighter spreads starting at 0.6 pips.

- MT4 Raw: $1,000 USD minimum deposit, 0.0 pip spreads, commission $7 per lot.

- MT4 Elite: for large traders, $30,000 USD for two months, spreads from 0.0 pips, $7 commission.

- MT5 Hedging/Netting: MT5 offers advanced stock trading with netting and hedging options.

- cTrader: suitable for professional, algorithmic trading with hedging execution system.

- FxPro Trading Platform: intuitive browser-based platform for novice traders.

Demo accounts are available for practicing trading strategies and gaining experience.

Useful tools:

In addition to the main trading functions, FxPro offers several additional tools:

- Economic Calendar: provides timely news affecting market prices necessary for fundamental strategies.

- Trading Central analytics: offers independent trading signals and forecasts for all asset classes.

- FxPro Squawk: broadcasts news updates in real time.

These tools and features, available after registration and deposit, are designed to enhance the trading experience and give traders a competitive advantage in the market.

Advantages

- Financial security: The broker guarantees each client compensation of up to 20,000 euros in case of financial losses due to extraordinary situations, thanks to a special insurance fund.

- Advanced analytical resources: Clients have access to professional analytics and innovative tools that support both manual and automated trading.

- High Speed Order Execution: The broker provides one of the best transaction execution times in the industry, which is critical for successful trading.

- Passive income through copy-trading: The platform offers convenient passive income opportunities by allowing clients to copy trades of successful traders.

AMarkets personal account overview

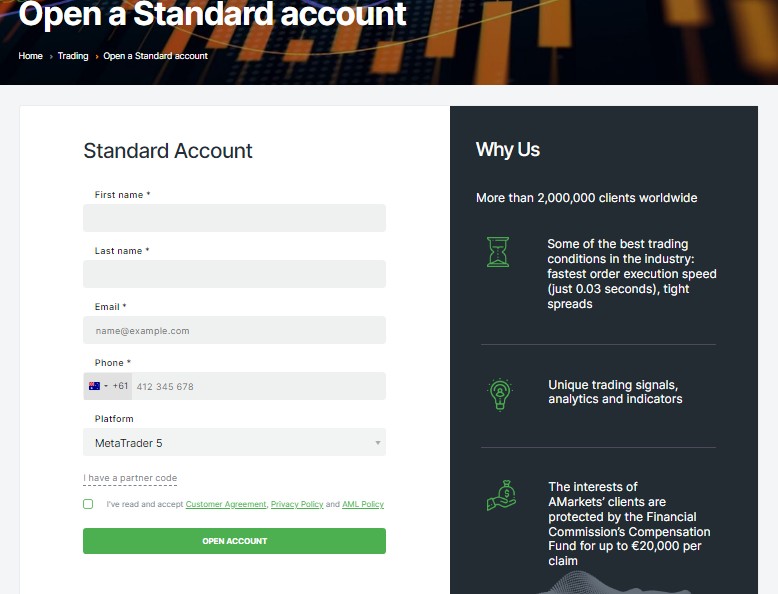

To start trading with AMarkets broker, you need to follow these steps:

1. Account opening: Go to the main page of AMarkets website and select the type of account you want to open – demo account, investor account or active trader account.

2. Registration: Complete the registration form by entering your personal information such as name, phone number and e-mail address. Confirm your registration by clicking on the link that will be sent to your e-mail.

3. Using myAlpari: The following features will be available in your myAlpari:

- Account Management: Open new accounts, change the type and leverage of existing accounts.

- Transaction Management: Depositing, withdrawing funds, making internal transfers.

Additional features of myAlpari:

- Analytical Tools: Access to sentiment indicator, trading advisors and other analytical resources.

- Copytrading Platform and Trading Platforms: Utilize a variety of trading tools and platforms.

- Achievement and Cashback Information: Track your progress and possible refunds.

- Access to AMarkets resources: Utilize a variety of educational and informational materials to improve your trading skills.

Answers to questions

-

How to register on AMarkets

-

What types of accounts are available at AMarkets

-

What deposit methods are available

-

How do I start trading on AMarkets

-

How to use the copy-trading service at AMarkets

-

What analytical tools does AMarkets offer

-

Is there any protection against negative balance in AMarkets

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ