Tickmill

Collected complete information about all forex brokers, explore all their advantages and start earning money

Open an accountTickmill (pronounced “Tickmill”) sets a new standard in providing brokerage services. With an emphasis on innovation, the company attracts traders by offering minimum spreads, making it particularly attractive to scalping and passive robot trading enthusiasts. Tickmill has won numerous awards along the way, including the titles of “Forex Broker with Best Execution” two years in a row (2018 and 2019), as well as the title of “Most Transparent Broker” in 2019.

Tickmill’s group of companies includes:

- Tickmill Europe Ltd: Regulated by CySEC, license 278/15 (Cyprus).

- Tickmill Ltd: Regulated by the FSA, registration number 09369927 (Seychelles).

- Tickmill UK Ltd: Regulated by the FCA, license 733772 (UK).

- Tickmill Asia Ltd: Regulated by Labuan FSA, license MB/18/0028 (Labuan, Malaysia).

- Tickmill South Africa (Pty) Ltd: Regulated by FSCA, license 49464 (South Africa).

Before registering, pay attention to the division of the broker where you are opening an account, as trading conditions may differ from jurisdiction to jurisdiction.

-

Account currency

Tickmill.EU - USD, EUR, PLN, CHF, GBP. Tickmill.com - USD, EUR, GBP

-

Minimum deposit

100$

-

Leverage

Tickmill.EU - up to 1:30/1:300. Tickmill.com - up to 1:500

-

Spread

on Classic account - from 1.6 points, on Pro, VIP accounts - from 0 points

-

Instruments

currency pairs, commodity market assets, stock indices, stocks, bonds, cryptocurrencies

-

Margin call / Stop out

100% / 30%

Pros

- Spreads from 0 pips: Tickmill offers minimum spreads starting from 0 pips, which attracts traders seeking more favorable trading conditions.

- Allow any strategies: The broker allows you to use any trading strategies, including scalping and passive trading with the help of robots.

- Negative Balance Protection: Tickmill provides negative balance protection, which prevents traders from losing more than their deposit.

Minuses

- Working hours of the support service: The support team is only open 5 days a week from 7:00 to 16:00 GMT, which can be inconvenient for traders from different time zones.

- Limited selection of currency pairs: The company offers a relatively small selection of currency pairs, which can limit traders' options.

- Lack of a cent account: Tickmill does not provide cent accounts, which can be inconvenient for novice traders who want to trade small amounts.

- Lack of trust management: The broker does not offer trust management services, which can be a disadvantage for investors who prefer passive management.

Customer geography

-

Poland 8.14%

Poland 8.14% -

Malaysia 7.87%

Malaysia 7.87% -

Qatar 6.38%

Qatar 6.38% -

South Africa 6.26%

South Africa 6.26% -

Thailand 5.72%

Thailand 5.72% -

China 5.22%

China 5.22% -

United Republic of Tanzania 4.88%

United Republic of Tanzania 4.88% -

Egypt 3.98%

Egypt 3.98% -

Vietnam 2.96%

Vietnam 2.96% -

Peru 2.73%

Peru 2.73% -

Others 45.86%

Others 45.86%

Expert evaluation

Tickmill is a broker for traders with basic trading experience seeking further development. The main attention is paid to the technological capabilities of the platform and technical tools. The real speed of transactions execution is up to 0.2 seconds, which is sufficient for scalping and algorithmic trading. The broker also guarantees the absence of slippages during volatility growth thanks to the system of client orders distribution, which helps to instantly find suppliers with current free liquidity.

A special feature of the broker is the use of artificial intelligence in technical tools. For example, Acuity Trading is an aggregator of news and fundamental information, which analyzes and provides only relevant data for a particular asset and timeframe. Signal Center is a technical analysis tool that not only shows the direction of a trade, but also finds key levels for placing pending orders.

Trading conditions are mainly focused on professional traders, but the Classic account is also suitable for beginners. Bonus programs are available only for units operating outside Europe. The company fully fulfills its obligations, providing full transparency of the user agreement and absence of problems with withdrawal of funds. Thanks to these qualities, Tickmill is stably kept in the TOP ratings of the best Forex brokers by Traders Union.

Analysis

Ribeit

Tickmill, an international forex, gold and silver broker, offers its traders a unique opportunity to double their income through an exclusive rebate program. This program allows you to receive a cash reward for each lot traded, thus increasing the trading potential and profitability of traders.

How does the Tickmill rebate program work?

- Account Opening: To become a member of the cashback program, you need to open a new trading account on MT4 or MT5 platforms as part of the Cashback campaign through the Trader’s Cabinet.

- Deposit: A deposit of at least USD 200 or equivalent in EUR/GBP/ZAR is required to activate the rebate program.

- Trading: Trade any currency pairs, gold (XAU/USD) or silver (XAG/USD) and earn cash rewards for each lot traded.

Cashback size

- Classic account: 2$ per lot traded.

- Raw account: 0.75$ per lot traded.

- Pro account: 0.50$ per lot traded.

- VIP account: 0.25$ per traded lot.

For example, on the Classic account a cashback of $15 will be credited for 7.5 traded lots.

Benefits of the Rebate Program

Tickmill’s rebate program not only increases your income from each trade, but also motivates you to increase your trading activity, so you can receive additional rewards every month depending on the number of lots traded. For experienced traders looking for increased rewards, Tickmill offers advanced trading tools and indicators that further enhance the effectiveness of trading strategies.

Please note that Pro and VIP accounts are not available for new Tickmill clients, which emphasizes the exclusivity of the offer for experienced market participants.

Tickmill prioritizes not only the quality of trading conditions, but also the ability of each trader to maximize the use of their capital and trading opportunities. The rebate program is a great way to increase your income using standard trading activity.

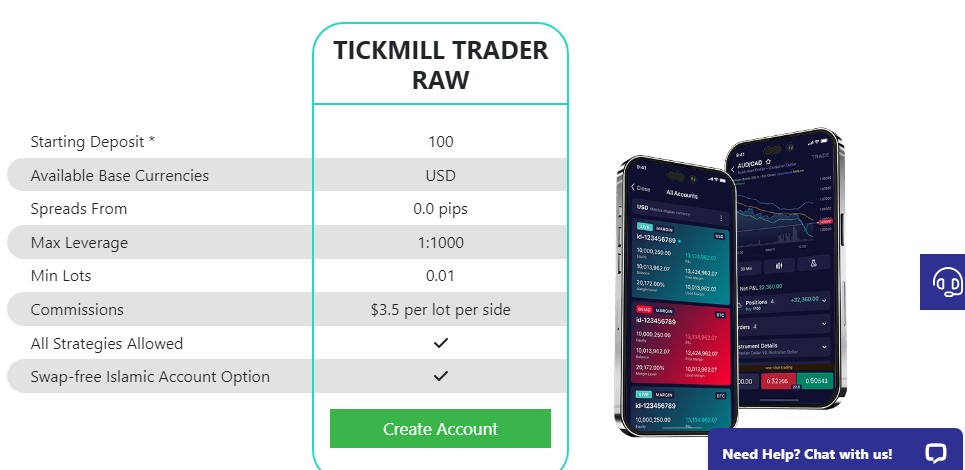

Trading conditions

Trading conditions at Tickmill are suitable for both beginners and professional traders. The broker offers the following account types:

- Classic account (Classic): Designed for beginner traders. This type of account has no commissions and provides transparent spread formation, which can be found in the specification.

- Pro and VIP accounts: Professional ECN accounts with virtually zero spread, instant order execution and a fixed commission per lot. These accounts are ideal for traders working with large volumes and using high-frequency trading strategies.

The minimum deposit for Classic and Pro accounts is 100 USD regardless of the trader’s jurisdiction.

Leverage depends on the broker’s division:

- Europe: Stricter conditions – leverage for retail clients up to 1:30 depending on asset type. Leverage increase up to 1:300 is possible only after obtaining the “Qualified/Professional” status.

- Other jurisdictions: More loyal conditions – leverage up to 1:500 regardless of the trader’s status.

Tickmill offers a wide range of trading assets, excluding ETFs and derivatives (exception – futures are available in the UK). Payment methods include banking systems and e-wallets, and cryptocurrency funding is also available for traders outside Europe.

-

Trading platform

MT4, MT5, MT4 Webtrader, Tickmill mobile application

-

Accounts

Classic, Pro, VIP, Demo

-

Account currency

Tickmill.EU - USD, EUR, PLN, CHF, GBP. Tickmill.com - USD, EUR, GBP

-

Deposit/withdrawal

Tickmill.EU - Bank Transfer, Visa, Mastercard, Skrill, Neteller, PayPal, Dotpay, Trustly. Tickmill.com - Bank Transfer, Visa, Mastercard, Skrill, Neteller, Webmoney, cryptocurrency payments.

-

Minimum deposit

100 dollars

-

Leverage

Tickmill.EU - up to 1:30/1:300. Tickmill.com - up to 1:500

-

PAMM accounts

no

-

Minimum order

0.01 lots

-

Spread

on Classic account - from 1.6 points, on Pro, VIP accounts - from 0 points

-

Instruments

currency pairs, commodity market assets, stock indices, stocks, bonds, cryptocurrencies

-

Margin call / Stop out

100% / 30%

-

Liquidity provider

Barclays

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Market Еxecution

-

Trading features

Hedging and scalping available

-

Contests and bonuses

yes

Commission

Our specialists have reviewed Tickmill brokerage company for various commissions. In the category of trading commissions the broker’s spread was analyzed, and among non-trading commissions – additional fees for withdrawal of funds from the trading account.

Broker Overview

Tickmill (Tickmill) is a brokerage company that attracts traders with low spreads and comfortable trading conditions. The company emphasizes on innovations, allowing clients to trade not only manually, but also to use services of automatic copying of deals of experienced traders and trading advisors. The extensive list of trading instruments includes not only currency pairs, but also bonds.

Tickmill is regulated by the Seychelles Financial Services Authority (FSA), the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Labuan Financial Services Authority (Labuan FSA) and the Financial Sector Supervisory Authority (FSCA) in South Africa. These regulators ensure the safety and security of traders’ funds.

Tickmill – an ideal broker for traders of any level

Tickmill (Tickmill) combines technology and wide functionality. The company offers a lot of educational materials that help traders master trading on the foreign exchange market. The minimum deposit is 100 dollars.

Tickmill is suitable for all types of strategies, including algorithmic trading, scalping, hedging and arbitrage. Auxiliary tools integrated into MT4 and MT5 platforms support EA trading. Indicators of volatility, current trading volumes, market sentiment and chart patterns are available for fundamental analysis.

The speed of order execution is about 200 ms, and the delay when copying signals via mobile application (Pelican) and MyFxBook AutoTrader can be up to 1-1.5 seconds.

Trading Conditions and Platforms

Tickmill provides fast execution of market orders with an average latency of about 150 ms. Traders can use the popular MetaTrader 4 terminal as well as the web-based platform.

Tickmill Auxiliary Tools:

- VPS: Virtual Private Server for seamless communication between your platform and the server. Rates start from 30 GBP per month.

- Infographics: Access useful information affecting currency quotes and comparative characteristics of the MT5 platform.

- Custom tools for MT4 and MT5: Includes 13 applications and 15 indicators for technical, graphical and fundamental analysis.

Account Types

Tickmill offers three account types with the possibility to deposit in euros, dollars and pounds. All accounts support trading with any strategies, the minimum lot size is 0.01.

- Pro: Minimum deposit – 100 USD. Floating spread from 0 pips. Fixed commission of 2 USD for each side of the transaction for 100 000 USD.

- Classic: Minimum deposit – 100 USD. Floating spread from 1.6 pips. No commission.

- VIP: Minimum deposit – 50 000 USD. Floating spread from 0 pips. Fixed commission of 1 USD for each side of the transaction for 100 000 USD.

Before opening a main account, clients can test the conditions on a demo account. The MetaTrader 4 platform is used for trading, which is also available in the web version.

Tickmill’s useful tools:

- Autochartist: Technical analysis tool for identifying price levels and patterns, forecasting scenarios and estimating volatility. Available on demo accounts with a delay of 5 candles.

- Economic Calendar: List of important news with filters by importance and country.

- Trade Calculator and Currency Converter: Automatically calculates pip value, swap and margin based on input data.

- Advanced Trading Toolkit for MT4/MT5: Includes 13 applications and 15 indicators such as news feed, market sentiment, hidden orders and correlation matrix.

- Acuity Trading: An artificial intelligence based tool that aggregates news information relevant to the current position.

- Financial Reporting Calendar: Useful for stock traders using fundamental strategies.

- Signal Center: A tool based on artificial intelligence that provides trading signals with key levels and target points.

- Market Sentiment Indicator.

Bonuses from Tickmill

Bonus offers are only available to Tickmill.com division customers:

- Trader of the Month: Contest with 1000 USD reward for the trader with the best result.

- Tickmill’s NFP Machine: Weekly contest to predict the value of the NFP instrument with a reward of up to 500 USD.

- 30 USD Welcome Account: Open a live account and get 30 USD without deposit. The bonus cannot be withdrawn, but the earned money is available for withdrawal.

Advantages

- Good liquidity: Ensures that trades can be executed quickly without significant price changes.

- Regulated activity: The work of the brokerage company is controlled by several regulators, which guarantees reliability and safety.

- Attractive trading conditions: Three account types, no swaps and low spreads make trading convenient and accessible for all levels of traders.

- Variety of trading instruments: Includes currency pairs, oil, precious metals, indices and bonds, allowing you to diversify your investment portfolio.

- Abundance of educational materials: Helps beginner traders to quickly familiarize themselves with the peculiarities of trading different instruments.

- Gap Protection: Prevents significant deposit losses; if the account reaches a set minimum, the trade is automatically closed.

- Flexibility in trading: Ability to trade using Expert Advisors, copy trades of other traders, as well as apply hedging and scalping strategies.

TickMill personal account overview

To make it easier for traders to get started with Tickmill (Tickmill) broker, read the information below:

1. Logging in to the personal cabinet

To log in to your personal Tickmill account, go to the main page of the broker’s website and click “Login”.

2. Authorization

Enter the user name and password for authorization.

3. Registration

If you are not registered yet, click “Open an account” and go through the registration procedure, including passport data verification.

4. Selecting the type of account

Choose the type of trading account that suits your needs.

5. Deposit and installation of the terminal

After registration/authorization, make a deposit to your account, download and launch the MT4 terminal.

6. Work in the personal cabinet

In your personal cabinet you can choose a trading instrument, use the broker’s bonuses and withdraw funds. You will also have access to:

- Current analytics

- Statistics of trading using Expert Advisors

- Statistics on the effectiveness of affiliate programs and their profitability

- Useful information for training

- History of positions and deposit/withdrawal operations

- Up-to-date quotes

- Support service for professional advice

Answers to questions

-

How can I register with a Tickmill broker

-

What types of accounts does Tickmill offer

-

What trading platforms are available to Tickmill clients

-

How can I deposit and withdraw funds

-

What trading tools does Tickmill offer

-

What training materials are available for Tickmill traders

-

How does negative balance protection work at Tickmill

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ