FXOpen

We have gathered complete information about all Forex brokers. Explore all their advantages and start earnin

Open an accountFXOpen, founded in 2003 in Cairo as a training center, started providing dealing services in 2005 and quickly became one of the leading players in the Forex industry. The company has grown to significant heights by offering optimal trading conditions, innovative technologies and a wide range of financial services. FXOpen was the first broker in the CIS to offer clients the opportunity to trade via electronic communication network (ECN) using the MetaTrader 4 platform. Currently, the company serves more than one million clients from one hundred countries, providing a full range of active and passive trading services. FXOpen is a member of the International Finance Commission and the Budget and Financial Markets Committee of the Russian Federation Council.

-

Account currency

USD, EUR, GBP, CAD, AUD, CHF, JPY, CNY, RUB

-

Minimum deposit

1 USD (Micro), 10 USD (STP, Crypto), 100 USD (ECN)

-

Leverage

1:3 (Crypto), 1:500 (Micro, STP, ECN)

-

Spread

Floating — from 0 pips

-

Tools

50 currency pairs, CFDs, indices, gold and silver, 43 pairs with BTC, LTC, EOS, PTC, ETH, DASH, EMC

-

Margin call / Stop out

От 20% / от 10%

Pros

- Favorable trading conditions: FXOpen offers conditions suitable for traders of all experience levels, ensuring a convenient trading environment.

- Wide range of financial instruments: The company provides a variety of trading tools, allowing traders to select the most suitable options.

- Various account types: Including a specialized Crypto account for cryptocurrency trading, catering to the unique needs of investors in this rapidly growing area.

- Low fees and cashback program: FXOpen minimizes withdrawal fees and offers a cashback program, helping to further reduce trading costs.

- PAMM service for trade copying: The platform offers the option to copy successful traders' strategies, an appealing solution for both novice and experienced investors.

- Access to automated trading: FXOpen supports automated trading options, enabling clients to optimize their strategies and efficiency.

- Convenient account reports: The company provides detailed account reports at the end of the trading day and month, making investment management and planning easier.

Cons

- Limited educational materials: FXOpen does not offer a broad range of educational resources, which may limit new traders from gaining the essential knowledge needed for successful trading.

- No callback feature: Clients cannot request a callback to get in touch with support, which could be inconvenient, especially in situations requiring immediate attention from the service team.

Client Geography

-

United States 9.06%

United States 9.06% -

United Kingdom 7.03%

United Kingdom 7.03% -

Malaysia 6.65%

Malaysia 6.65% -

Ukraine 4.79%

Ukraine 4.79% -

Iraq 3.71%

Iraq 3.71% -

Japan 3.7%

Japan 3.7% -

Italy 2.3%

Italy 2.3% -

Kenya 2%

Kenya 2% -

Hungary 1.7%

Hungary 1.7% -

Indonesia 1.7%

Indonesia 1.7% -

Others 57.36%

Others 57.36%

Expert evaluation

FXOpen, a well-known broker on the international Forex market, is an accredited partner of the International Organization of Financial Traders (IOFT) and strictly complies with all regulatory requirements. Due to its stable operation and reliability, FXOpen is recommended for professional cooperation. The broker provides a variety of trading conditions that are suitable for both beginners and experienced traders. Clients have access to trading more than 70 currency pairs, as well as precious metals, stocks, indices and cryptocurrencies.

According to MOFT analysts, FXOpen regularly ranks high in the rankings of the best brokers, confirming this with many positive customer reviews compared to negative ones. In case of questions or problems, FXOpen’s support team provides solutions promptly, which improves the client experience.

FXOpen’s website is characterized by easy navigation, allowing traders to efficiently find the information they need. The company’s trading platforms provide fast and stable operation, which is an important aspect in the dynamic Forex trading environment.

Analysis

Rebate

Partnership with the MOFT rebate service provides traders with an opportunity to significantly reduce their trading costs. Free registration on the MOFT website is required to participate and receive spread compensation. Rebates are accrued monthly after opening a live account with FXOpen and actively trading on Forex. It is important to note that spread compensation is paid not only for profitable trades, but also for losing trades.

Detailed information about MOFT rewards: The amount of the rebate depends on the type of trading account:

- For STP accounts – the rebate is 2.4 points.

- For ECN and Crypto accounts – 15% of the commission paid.

Traders receive 80% of these rebates.

Calculation example: Suppose you trade 1 lot per day on EUR/USD, where 1 lot equals 100,000 units of the base currency. With a pip cost of USD 10 and a spread of 2 pips, the daily spread cost would be USD 20. Based on MOFT conditions, 15% of the commission is returned by the service, of which 80% is transferred to the trader. Therefore, the amount of compensation will be 2.4 USD per day.

Trading conditions

FXOpen offers attractive trading conditions that are suitable for both beginners and experienced traders. The company offers a variety of account types, each with its own advantages, including accounts with significant leverage. For example, the Micro account with a minimum deposit of only 1 dollar provides ideal conditions for beginner traders. In addition, the broker offers demo accounts with virtual funds to study trading conditions and terminal functions.

All account types allow hedging and the use of expert advisors. ECN and STP accounts support scalping, news trading and telephone dealing. The Micro account allows you to trade 28 currency pairs as well as gold and silver, while the STP and ECN accounts provide access to 50 currency pairs, CFDs and indices. The Crypto account is focused exclusively on cryptocurrency trading.

FXOpen accounts are characterized by a floating spread starting from 0.0 pip, which is especially attractive for automated trading via MyFXbook and ZuluTrade systems. A special no-wap account is available for Muslim traders who participate in trading currencies, metals and CFDs.

The company regularly organizes contests for its clients and provides a rich assortment of information resources, including economic news, analytical reviews and a calendar of economic events on the official website. FXOpen clients can also receive detailed reports on their account status at the end of each trading day and month.

-

Trading platform

MetaTrader 4, MetaTrader 5, WebTrader, mobile tradin

-

Accounts

Demo, Micro, ECN, STP, Crypto, Islamic accounts

-

Account currency

USD, EUR, GBP, CAD, AUD, CHF, JPY, CNY, RUB

-

Deposit/withdrawal

VISA, MasterCard, Maestro, Discover, JCB, MIR, WebMoney, YooMoney, QIWI, Skrill, Neteller, Perfect Money, bank wire transfer, debit cards, credit cards, prepaid codes

-

Minimum deposit

1 USD (Micro), 10 USD (STP, Crypto), 100 USD (ECN)

-

Leverage

1:3 (Crypto), 1:500 (Micro, STP, ECN)

-

PAMM accounts

no

-

Minimum order

0.1 micro lot (Micro), 0.01 lot for all other accounts

-

Spread

Floating spread — from 0 pips

-

Instruments

50 currency pairs, CFDs, indices, gold and silver, 43 pairs with BTC, LTC, EOS, PTC, ETH, DASH, EMC Automated trading, cryptocurrency trading, news trading, Islamic accounts

-

Margin call / Stop out

От 20% / от 10%

-

Liquidity provider

Dresdner, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JPMorgan, Morgan Stanley, Deutsche Bank AG, RBS, CITI, UBS, Hotspot INST, Goldman, LavaFX

-

Mobile trading

yes

-

Affiliate program

yes

-

Order execution

Instant Execution, Market Execution

-

Trading features

Автоторговля, криптовалютный трейдинг, торговля на новостях, исламские счета

-

Contests and bonuses

no

Commissions

Experts of the International Organization of Financial Traders (IOFT) conducted a detailed analysis of the terms and conditions provided by FXOpen broker in order to determine both trading and non-trading commissions. The analysis of trading commissions focused on the spreads set by the broker. As for non-trading commissions, the amount of additional fees for withdrawal of funds was assessed. It was found that the commission fees for account replenishment vary from 0% to 2.5%, depending on the chosen replenishment method.

Broker review

FXOpen provides traders with a wide range of trading opportunities, including access to Forex, CFDs, cryptocurrencies, precious metals and stocks. Clients can take advantage of trade copying and automated trading services, as well as have the opportunity to earn additional income through participation in a multi-level affiliate program. The broker also offers comprehensive risk management tools such as stop loss, negative balance protection and limit orders.

FXOpen Markets Limited is registered on the island of Nevis under registration number 42235 and is a member of the International Finance Commission.

The company actively supports traders of all levels, offering different types of accounts: Micro for beginners with minimal risks, as well as ECN and STP for experienced traders who prefer scalping. The Crypto account is designed for those who specialize in cryptocurrencies.

The MetaTrader 4 and MetaTrader 5 platforms are available for trading and can be used on Windows, Android and iOS devices. FXOpen uses advanced bridge technology for efficient execution of trades on ECN accounts, and also offers the possibility to trade via web terminal.

FXOpen offers a variety of account types adapted for traders of different experience levels, from beginners to professionals. These accounts differ in terms of minimum deposits, spreads and leverage.

Types of accounts and their features:

- Micro: This cent account is ideal for beginners, allowing you to trade gold, silver and 28 currency pairs. The minimum deposit is just $1, with leverage up to 1:500. Transactions are executed instantly.

- ECN: Standard account for experienced traders with a minimum deposit of $100. Offers access to trading 50 currency pairs, gold, silver, indices and CFDs. Spreads are floating, starting from 0 pips, and leverage is also up to 1:500.

- STP: An account with direct order processing, designed for professional traders. Offers floating spreads from 0 pips and leverage up to 1:500. Supports scalping.

- Crypto: Specialized account for trading cryptocurrencies. Requires a minimum deposit of $10 and offers floating spreads from 0 pips. Leverage ranges up to 1:3 and telephone dealing is available.

In addition, FXOpen provides an opportunity to open a free demo account. This allows traders to test trading conditions using virtual funds without the risk of losing real money.

RAMM technology – transaction copying service: FXOpen’s RAMM is an automated platform that allows investors to participate in Forex trading without in-depth knowledge and involvement in every transaction. Investors subscribe to the strategies of experienced traders (providers) and allocate a certain amount of money to copy these transactions. After joining PAMM, the provider’s actions are automatically repeated on the subscribers’ accounts.

Features of RAMM service:

- Compatible with ECN, STP and crypto accounts.

- There is no limit to the number of providers an investor can connect to.

- Investors control their funds and can adjust their capital.

- Automatic distribution of profits and losses in accordance with the terms of the offer.

- Public access to the system of monitoring of provider’s actions through graphs and tables.

FXOpen Affiliate Program: The program allows traders to earn money on attracting new clients based on the number of attracted clients and their trading turnover. The reward structure is as follows:

- Level 1: 100% of the standard commission;

- 2nd level: 35% of the standard commission;

- Level 3: 10% of the standard commission.

The standard commission on STP accounts is 2.4 points, on ECN and Crypto accounts – 15% of FXOpen’s commission. As the trading volume of referred clients increases, multipliers are applied to increase the affiliate commission, which depends proportionally on the total margin of all closed positions of referrals over the last 90 days.

Withdrawal via FXOpen broker

FXOpen allows traders to submit withdrawal requests without a limit on the number of requests. The amount of commission depends on the selected payment system:

- Available payment methods: Clients can use various methods to withdraw funds, including VISA, MasterCard, Maestro, Discover, JCB, MIR, WebMoney, YooMoney, QIWI, Skrill, Neteller, Perfect Money, as well as bank transfers and debit and credit card transactions.

- Crediting time: Funds sent to e-wallets or bank cards are credited within one day. If a bank transfer is used, the process may take 1 to 3 business days.

- Withdrawal Currencies: FXOpen processes transactions in such currencies as RUB, USD, EUR, GBP, CAD, AUD, CHF, JPY, CNY.

FXOpen Support Service

- Mode of operation: Customer support is available 24 hours a day, 5 days a week (24/5), answering general questions via online chat. Emails and tickets are processed between 7am and 4pm GMT on weekdays, covering new customer questions, payment transactions, trading desks and technical support.

Advantages

- Wide range of instruments: Traders have access to trading currency pairs, stocks, indices, and cryptocurrencies, providing a diverse range of trading options.

- Specialized crypto accounts: Separate trading accounts are available for cryptocurrencies, including Bitcoin, Litecoin, and Namecoin, allowing traders to specialize in popular digital currencies.

- Variety of trading accounts: A selection of accounts, including ECN, STP, Crypto, and Micro, caters to traders with different preferences and strategies.

- Competitive spreads: Low floating spreads starting from 0 pips reduce trading costs.

- Accessible minimum deposit: Trading can begin with a minimum deposit of just $1, making FXOpen accessible to traders with any budget.

- Advanced technology: ECN aggregation ensures high-speed and accurate order execution.

- High leverage: Maximum leverage of up to 1:500 increases the potential for trading operations.

- Up-to-date information: Traders receive access to the latest economic news, market analysis, and event calendars to assist in making informed decisions.

- Detailed reports: Daily and monthly account reports help traders track and analyze their trading activities.

FXOpen personal account overview

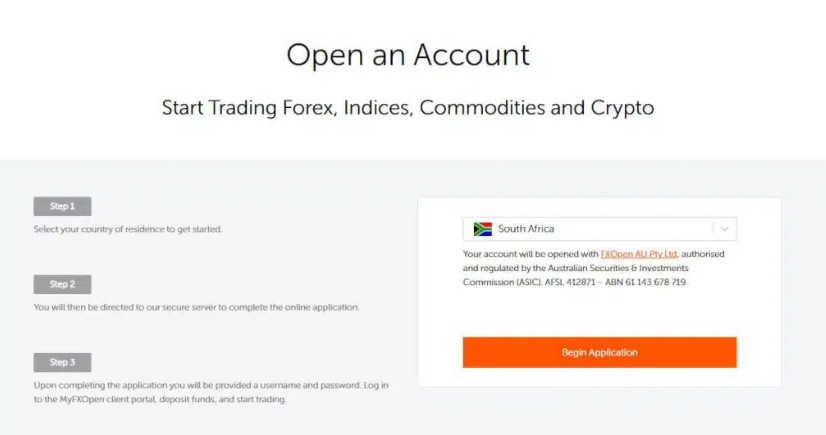

Follow the steps below to get started with Forex through FXOpen broker:

Account Registration:

- Go to the FXOpen homepage and click on the “Open an account” button.

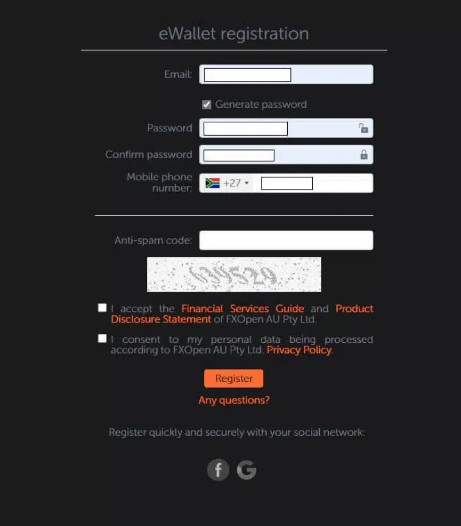

- Select the “Register” option. Enter your email, country of residence and phone number.

- After registration, a 4-digit pin-code will be sent to the specified email. Keep it, as you will need it to confirm financial transactions on your account, including withdrawals.

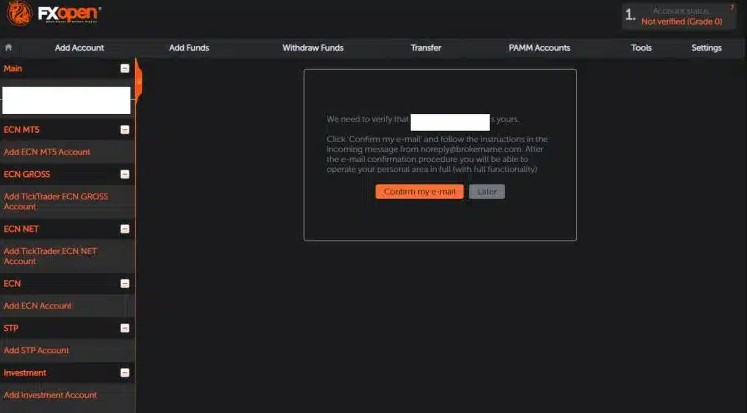

Authorization in the system:

- Enter the e-mail address specified during registration and the automatically generated password.

- Confirm your email and then go through the mandatory verification procedure, providing accurate information.

Use of a personal account:

- Open a trading account: Select the appropriate account type in myAlpari and follow the instructions to open it.

- Fund your account: In the Funding section, select a convenient deposit method.

- Download trading platform: Download a trading platform suitable for your operating system to start trading.

- Withdrawal: Request a withdrawal by selecting your preferred withdrawal method.

- Affiliate Program: Sign up for the program to start receiving rewards for referring new clients.

These steps will help you successfully start forex trading with FXOpen and maximize the opportunities provided by the broker.

Frequently Asked Questions

-

How can I open a trading account with FXOpen?

-

What types of accounts are available at FXOpen?

-

What deposit and withdrawal methods are available in FXOpen?

-

Does FXOpen offer automated trading options?

-

What security measures does FXOpen apply to protect clients' funds?

About the broker

About the broker  Customer geography

Customer geography  Top 3 reviews

Top 3 reviews  Analysis

Analysis  Development dynamics

Development dynamics  Ribeit

Ribeit  Trading conditions

Trading conditions  Commissions

Commissions  Broker Overview

Broker Overview  LC overview

LC overview  FAQ

FAQ